FAB Balance Check – 8 Fast & Reliable Ways to Check Account Balance

Can’t find a trustworthy way for your FAB balance check? Tired of complicated steps that waste your precious time? Many people struggle daily just to get their current account balance, whether they’re trying to make a payment or simply want to know how much money they have.

We’ve got you covered with 8 simple methods that actually work. From mobile banking to SMS, ATMs to online portals, you’ll find the easiest way that fits your situation. These tested methods work for all card types, Ratibi, salary, debit, or credit cards, and take just seconds to complete.

Explore FAB Banking Services in One Place

Not sure where to start? Don’t worry.

Whether you’re searching for FAB branches, ATM locations, online banking, or card services, everything is organized below.

Click on any button to open a complete, easy-to-understand guide related to that topic.

This way, you save time and get the right information without unnecessary searching.

What is FAB Balance Check?

FAB Balance Check is a convenient and reliable banking service that helps First Abu Dhabi Bank customers view their current account balance and recent transaction history. This service allows users to check their balance instantly using both online and offline methods, without the need to visit a bank branch.

When you use the FAB Balance Check service, you receive real time updates about your account activity. This makes it easier to track how money is coming in and going out of your account, helping you manage your finances more effectively. It is especially useful for customers who want to stay aware of their daily spending, incoming payments, and withdrawals.

Whether you access your account through the FAB mobile app, internet banking, an ATM, or SMS banking, FAB Balance Check provides accurate and up to date information at all times. By regularly checking your balance, you can plan your expenses better, avoid overspending, and reduce the chances of unexpected charges.

How to check FAB Balance

FAB Balance Check Online – Fastest Ways to Check Balance Anytime

A FAB balance check online is the fastest and most convenient way to monitor your account without visiting a branch or ATM. Users can check their balance online through the FAB Mobile App, the official FAB website, or the PPC Inquiry Portal. These online methods provide real-time balance updates, transaction history, and secure access from anywhere. Online balance checking is ideal for users who want instant results and better control over their finances. A stable internet connection and registered account details are required for online access.

8 Step-by-Step and Super-Fast Ways to Check Your FAB Balance

If you have any problem checking your FAB balance, we have the best methods to solve it. You can check your balance online or offline. Here are 8 possible authentic methods you can use to check your balance.

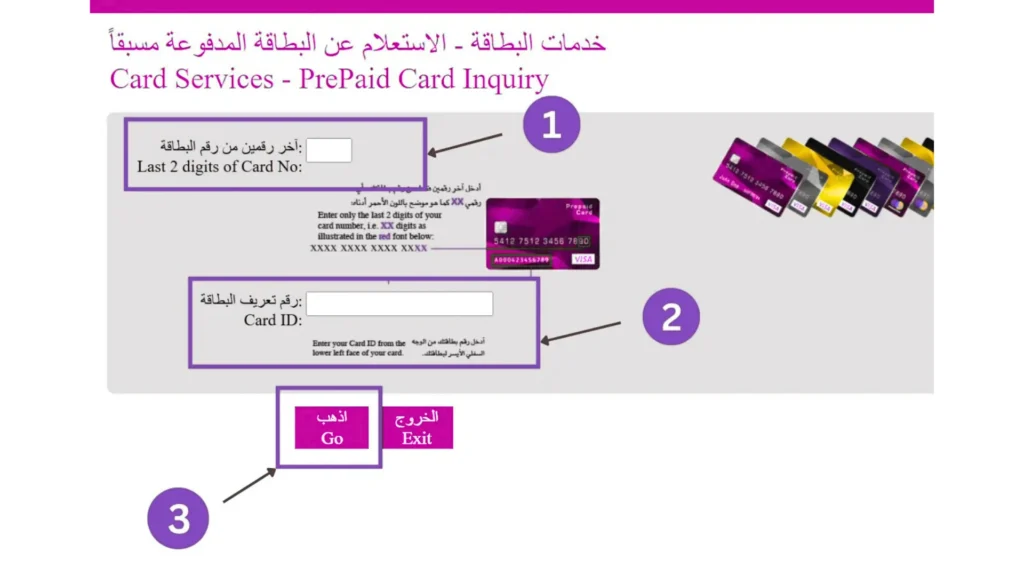

Ist Step: FAB Balance Check Through PPC Inquiry Portal (Fastest Option)

The PPC inquiry portal (also known as “PPC Magneti”) is the best and recommended method for the FAB balance check. It solves your problem in seconds. You just have to put the real and true information in this portal. It is also easy to use the portal.

The PPC inquiry portal allows you to check your balance online. It means you must have an internet connection to perform this inquiry. Make sure you have your debit/credit card with you. Here is how you can check the balance through the PPC inquiry portal step by step.

Steps

- Search on Google: PPC inquiry portal OR click here.

- Fill the Form: Enter the last 4 digits of your card number.

- Card ID: Enter your card ID number.

- Captcha: Enter the captcha text from the image in the box.

- Submit: Click on the Go button and receive your balance inquiry.

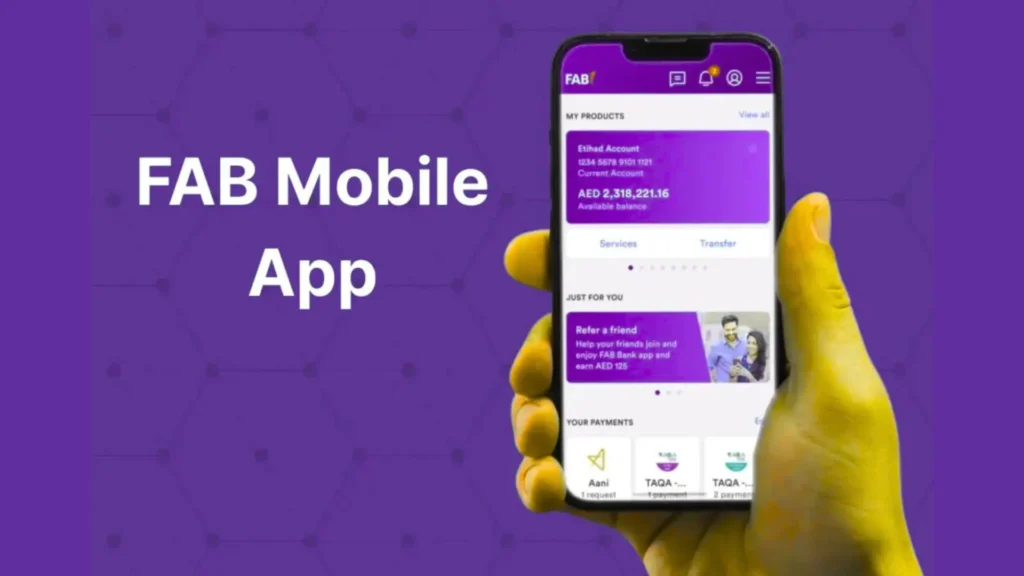

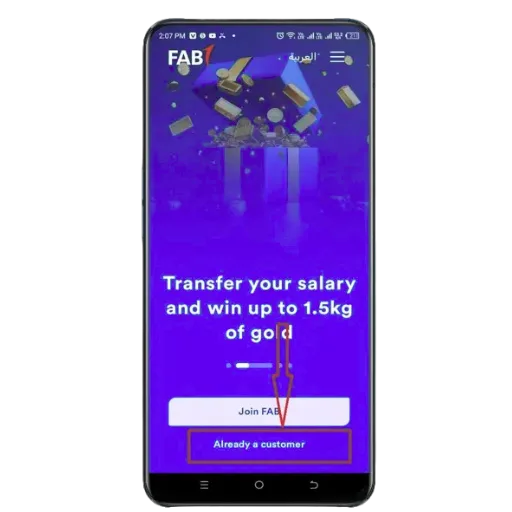

2nd Step: FAB Balance Check Using the FAB Mobile App (Highly Recommended)

The 2nd method you can use to check your First Abu Dhabi Bank balance is the FAB mobile app. It is a very useful method for sort of having your balance information easily. You can have your balance information in seconds with this app.

A mobile is always available in your pocket; if you suspect any type of scam, you can check it easily. If you find any scam, you can report it to the bank as long as you check your balance. Here is the complete step-by-step guide to checking your balance through the FAB mobile app.

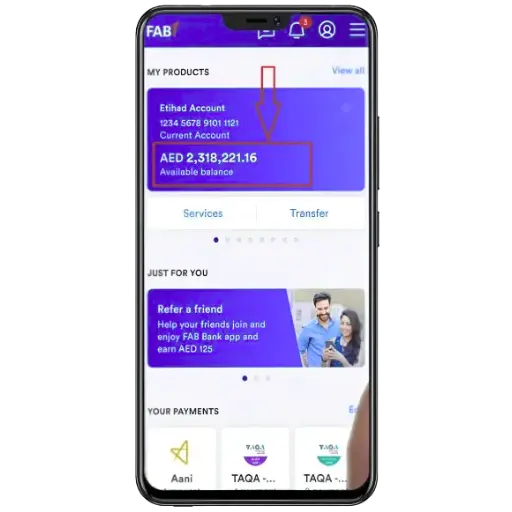

If you’re already logged in to the FAB mobile app, follow these steps:

If you’re already logged in to the FAB mobile app, follow these steps:

Steps 1:

- Download app: Download the FAB mobile app from the Google Play Store or App Store.

- Log in: Log in through the username and password in your account.

- Check Option: Click on the “check balance” option in the middle of the screen.

- Home Screen: Your balance will be visible on the home screen in the top left corner.

If you do not have a mobile account, follow these steps:

Steps 2:

- Register: Register on the FAB mobile app.

- Enter details: Enter your ID or credit/debit card.

- Set security: Set your username and password.

- Log in: Log in through username and password.

- Check Balance: Check your balance on the home screen.

- Log out (optional): You can log out after checking your balance from the app.

How to Download FAB Bank Statement Using the Mobile App

Steps 3:

- Log in to your account.

- Check your balance on the home screen.

- Click on the Bank Statements section

- Choose the date and month of the transactions.

- The statement will be visible. Click on download.

- Open it on your mobile and check the transaction history.

3rd Step: FAB Balance Check via SMS Banking

If a user does not have an internet connection, they can choose SMS banking. It is also a reliable method for the offline users. You will have to send the message to the official FAB number.

For the FAB balance check, through SMS, it will take one to two minutes. After some time, you will receive an SMS. This SMS will contain your balance. Here is the step-by-step guide for you to check your balance through SMS.

Steps

- Open SMS Application: Open your SMS application through your registered mobile number.

- Create Message: Create your message and type the following: BAL XXXX.

- Replace Numbers: Replace four numbers with XXXX.

- Send the message and wait: Send the message to 2121 and wait for the reply.

Note: Charges may apply for sending SMS to the bank number.

4th Step: Phone Banking (Perfect for Non-Digital Users)

The 4th method you can use for the FAB balance check is phone banking. If you do not have any technical knowledge about the internet or apps, you can use this method. It is a completely offline method for the new bank users.

Many of the new users do not know how to check their FAB balance online. So, it always becomes the best method for them. Here is the step-by-step guide on how to check your FAB balance through phone banking.

Steps

- Keep Documents: Keep your ID card and debit/credit card with you.

- Phone Numbers: You can use the following numbers for the phone call.

For Customers within the UAE: 600 52 5500 For Customers outside the UAE: +971 2 681 1511

- Call: Call the help center at these numbers.

- Tell your information: Tell your complete information on the call and get your balance.

FAB Virtual Assistant—Important Information You Should Know

When you make a call to the FAB help center, you are directed to an AI agent. This AI agent checks your matter and handles it accordingly. If your problem is technical, it directs you to a human.

It depends on the AI agent whether you will be directed to a human or not. So, in your case, there is no need for a human. You simply provide your information during the call, and you receive the answer to your inquiry.

Note: Calling the virtual agent may take some time. So, if you call the bank help center, be patient and wait for your query. It usually happens on busy days, such as Mondays.

5th Step: Check Online via the Official Website

Steps

- Visit Website: Visit the official website of FAB, or click here.

- Register: If you are new to the website, click on register and follow the next steps.

- Check Login Option: Click on the login option at the top right corner of the menu.

- Personal Details: Click the personal details option for the FAB balance check.

- Enter Details: Enter the username and password you set during registration.

- Check balance: Check your balance on the screen.

- Balance not showing: Click on the accounts tab and select your relevant account type.

- Log Out (Optional): Log out of the website after the FAB balance check.

6th Step: FAB Balance check using ATM (Complete image guide)

ATM is the best and most reliable offline method for FAB balance checks. It is easy to use, and you can also withdraw your funds. ATMs are also the authentic way of checking a balance.

Here is the step-by-step guide on how to check the FAB balance through the ATM.

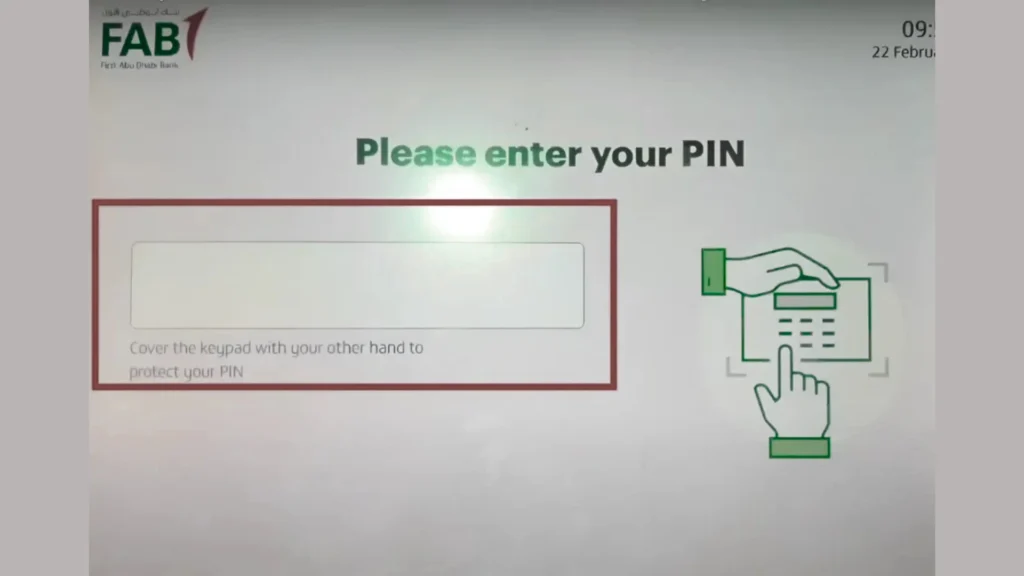

Steps

- Visit the ATM: Go to the nearby ATM for the inquiry.

2. Insert Card: Insert your relevant card.

3. Enter PIN: Enter your 4-digit PIN.

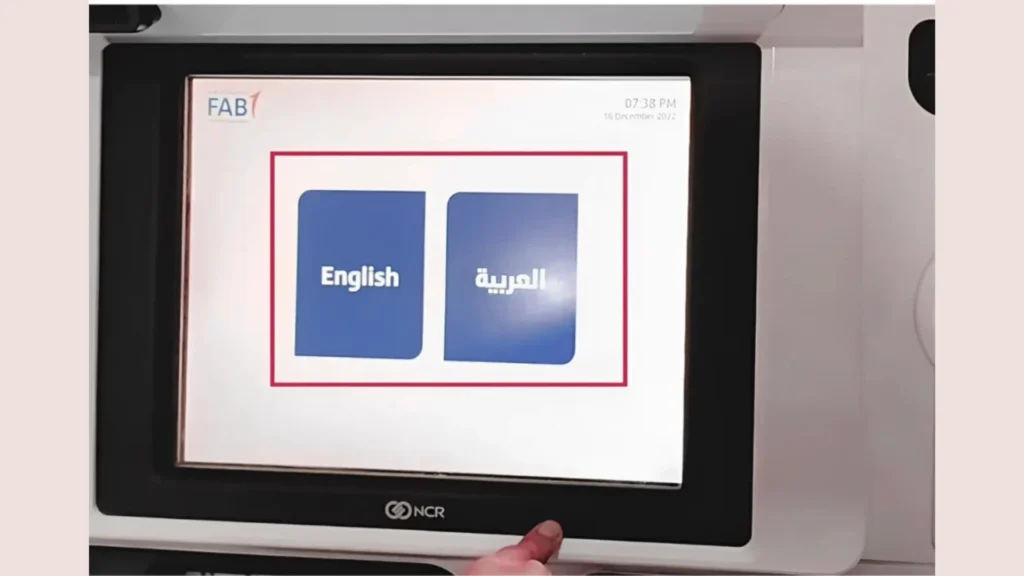

4. Choose Language: Choose one language from English and Arabic.

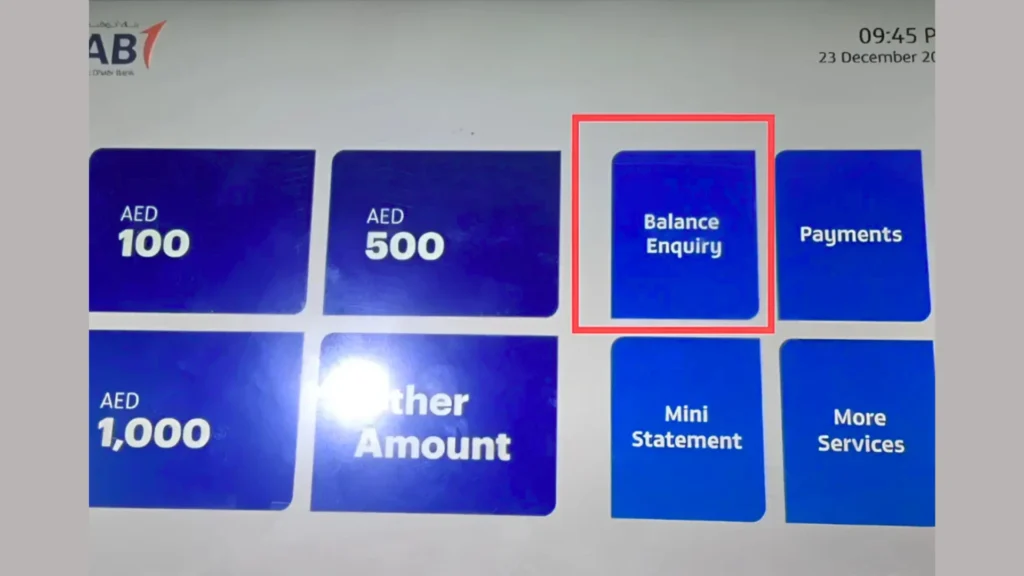

5. Choose Account Type: Click on the relevant account type (e.g., Current, Savings, Islamic, etc.).

6. Choose your inquiry: Choose the “Check balance” option from the menu.

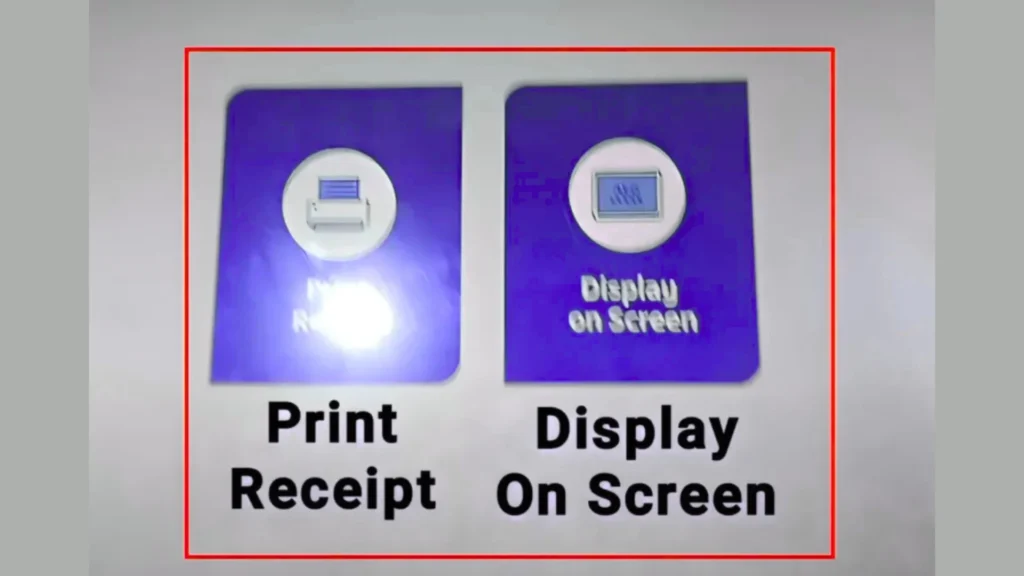

7. Hard or soft balance: Choose “Print receipt (charges may apply)” or “On-screen option

8. Get your balance: Print your balance on the receipt or on the display screen.

9. Remove Card: Always remove the credit/debit card after the FAB balance check.

7th Step: FAB Balance Check by Visiting the Bank Branch

The most valid but time-consuming option for checking the balance is visiting the bank branch. When you visit the bank branch, they will clear everything. You can ask any query or any question.

First Abu Dhabi Bank has good customer service. However, if the day is too busy, you may have to wait for some time. Here is the step-by-step process: you check your balance by visiting the branch.

Steps

- Visit the bank: Visit the nearest bank branch.

- Bring documents: Bring the necessary documents, like ID and your bank card.

- Get the token: Get the token from the token machine.

- Talk to the Bank Person: Talk to the person assigned to you.

- Get your balance: Get your bank balance from the bank person.

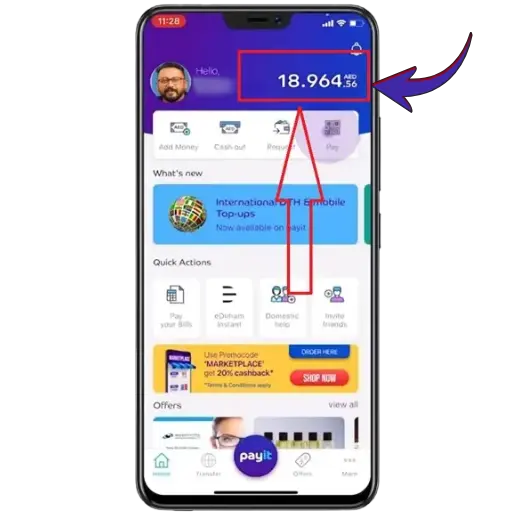

8th Step: FAB Balance Check Using the Payit Wallet App

Payit is the wallet app used to manage the funds. The bank customer can easily check their balance through this app. The user can send or receive funds through this.

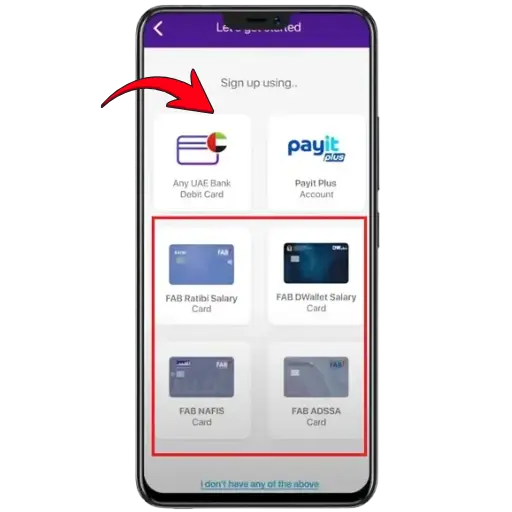

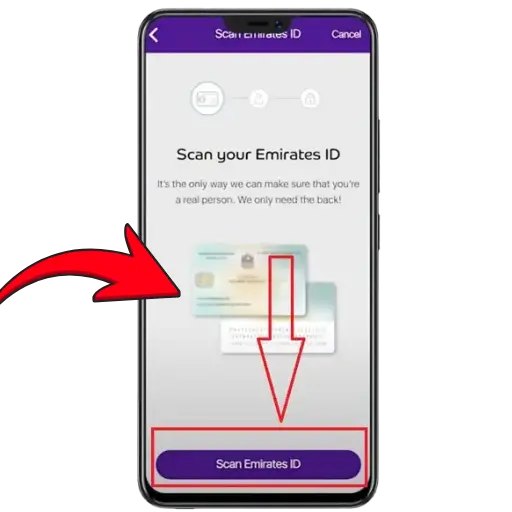

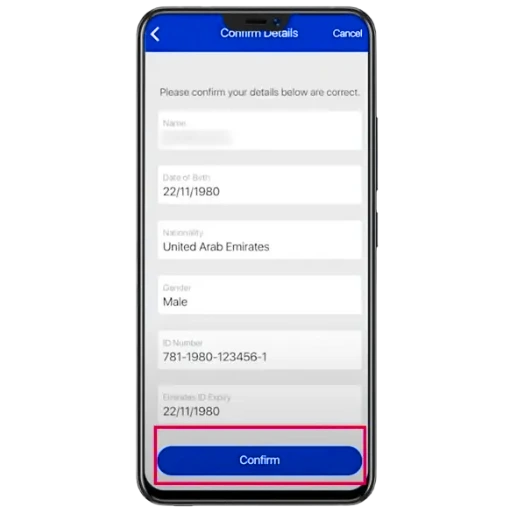

Here is the step-by-step process for checking your FAB balance through the Payit wallet app.

- Install Payit: Install the Payit wallet app from the Google Play Store or App Store.

2. Sign Up: Sign up with your account and set a password.

3. Login: After the sign-up up, log in with the details

4. Follow Easy Steps: Follow the steps Payit may want you to do.

5. Check Balance: Check your balance from the Payit Wallet home screen.

6. Log out (optional): Log out of the app.

How to Check NBAD Bank Account Balance?

NBAD (National Bank of Abu Dhabi) and FGB (First Gulf Bank) merged to make a single bank, FAB (First Abu Dhabi Bank). NBAD (National Bank Abu Dhabi) is also known as FAB (First Abu Dhabi Bank). It is the former name of First Abu Dhabi Bank. So, users can also check the balance through the FAB Mobile App, Payit Wallet, physically at the Bank, ATM, SMS service, PPC inquiry portal, etc.

All these methods are valid and useful for every type of user. Users can check their NBAD balance online and offline with these methods.

FAB Balance Check Online Options for Every Customer Type

Customer | Best Methods for Balance Inquiry | Important Note |

|---|---|---|

FAB Salary Account |

| You cannot choose the Payit Wallet app for salary balance checks. Salary option is not available in Payit. |

Ratibi or any other Prepaid Card |

| You can use every method to check Ratibi’s card balance. It has various advantages with no service charges applied. |

Credit/DebitCard Users |

| In the FAB mobile app or online portal, there is a slight difference in checking the balance of a credit/debit card. “Open the mobile app and head on to the “Card Management” section for checking the credit/debit card balance.” |

NBAD Users (now called FAB) |

| You have to use your NBAD login details. |

International Users |

| SMS banking is not available for international users. You may be charged international call or data charges for phone banking. |

FAB Balance Check Salary – Complete Guide for Salary Account Users

Checking your FAB salary balance is simple if you know the right method for your account type. Salary account holders can instantly view their balance using the FAB Mobile App, online banking, ATM, or SMS banking. The most reliable option is the FAB Mobile App because it shows real-time salary credits and deductions. Payit Wallet does not support salary balance checks, so salary users should avoid that option. Regularly checking your FAB salary balance helps you confirm timely salary deposits and detect any deduction errors early.

Comparison of All First Abu Dhabi Bank Balance Inquiry Methods

PPC inquiry Portal | FAB Mobile App | Official Website | SMS Banking | ATM | Phone Banking | Branch Visit | Payit |

|---|---|---|---|---|---|---|---|

The PPC portal always provides real-time information about the balance. It is free and unlimited. The user can check the history of the recent transaction. It has good security, a user interface, and mobile access. | The FAB mobile app has always real real-time information. Ionlyt just contains the balance info. The user can also get other data and resources, like their bank balance and transactions. It is also free and just needs an internet connection. | You can visit the official website of FAB through search engines. It is just available for online users. You cannot access it without an internet connection. | SMS banking is slightly different from all other transactions. It is offline, but it has some charges for a balance inquiry. On the other hand, if you subscribe the SMS banking, you can get an update of your balance daily. | ATM is the best offline method for FAB balance checks. You just need your card and should remember the 4-digit PIN for this inquiry. | Phone banking is just good for non-technical customers. However, it has a drawback as you can wait for a long time for any inquiry on busy days. | If you have time to go to the branch, it is another good offline option for you. If you do not even know about phone banking or SMS banking, you can choose this method. | The Payit wallet app is for all. It offers various services for free. However, users may find it difficult to find their inquiry option. |

FAB Balance Check Enquiry Problems and Their Solutions

Bank customers mostly feel awkward facing problems with inquiries. So, they should know about every problem and its solution for a better and faster experience. Here are all the problems you can face for the FAB balance check with their solutions.

Login Errors

Problems: Login error is the problem most users face. Sometimes users enter wrong credentials or forget their passwords.

Solution: Try again 2 to 3 times, or click on the forgot password method. You will get a link in your attached email. If it is any other technical error or you know nothing, use phone banking for your problems.

ATM-Related Issues

Problems: ATMs are mostly used for cash withdrawal. Sometimes, there can be a server issue, and you may not continue your transaction.Solution: Try again after some time or talk to the bank’s help center for more information.

SMS Banking Errors

Problems: It mostly happens when you send a message to the ban, and there is no reply. What is the reason? The reason ithat s you may not have a balance in your phone number. You may have entered the wrong details or made any typos. Bankservicee can also be down for some time.

Solution: The solution is simple. Check all the details, your phone balance, and all the details. If everything is right, then there will be a bank issue. Wait for some time, and if nothing happens, use any other method.

Mobile App Troubles

Problems: When FAB customers face mobile app troubles, they usually have a low internet connection.

Solution: Check your internet connection and try again.

Online Banking Problems

When you head over to the bank website for a FAB balance check and you face any issue, it is mostly a problem. It has no solution until the bank server works properly.

Top Reasons to Regularly Check Your FAB Account Balance

Here is why you should check your balance on a regular basis.

- Detect Unusual or Fraudulent Transactions: You can detect any unusual or fraudulent transactions if you check your balance daily.

- Avoid Overdrafts and Penalty Fees: The bank may charge you some fees and deduct from your balance. If it happens without any reason, you can find it well.

- Verify Transaction Accuracy: When you make a transaction, you can check its accuracy, as banks sometimes release a lower balance.

- Expense monitoring: You can also keep an eye on your daily expenses and track their records.

Overview of First Abu Dhabi Bank (FAB)

- First Abu Dhabi Bank is the most established bank in the UAE and a leading financial institution also. It has a good reputation around the globe. National Bank Abu Dhabi and First Gulf Bank merged to form the first Abu Dhabi bank.

- FAB was established in April 2017. It has now become a well-known bank in the UAE. It provides loans, e-finance, insurance, and many more services.

Types of FAB Bank Accounts in the UAE

There are three types of FAB bank accounts in the UAE:

- Digital Salary Account (Payit Plus): A digital salary account in the FAB is used for salaried persons. It allows you to manage your account with salary alerts. The online and mobile app banking is also available in this account type.

- Savings Account: A savings account is used for interest and accumulating wealth. It is commonly a personal goal account type.

- Current Account: A current account is used for paying bills and receiving income and is best for businesses’ daily transactions with no interest.

FAB Customer Support

General Customer Care Helpline Numbers

For UAE Folks: 600 52 5500

For International Customers: +971 2 6811511

Main Office:

First Abu Dhabi Bank

Al Qurm – Business Park

P.O. Box 6316

Abu Dhabi, United Arab Emirates

Customer Care Email:

Email: atyourservice@bankfab.com

Conclusion

We have provided you with the complete guide for the FAB balance check with various methods. The bank customer support is 24/7. You can also check their customer support if you have any queries. Check your balance daily and be aware of fraud and any charges.

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.