FAB Bank Salary Check Account Balance Check Made Simple – Online & Offline Guide 2026

Want to know how to check your FAB Salary account balance online and offline? When was your salary credited, and what are the associated charges? What is the salary balance remaining in your FAB salary account?

Professional customers earning more than AED 5,000 often experience these issues. There are six methods you can use to do the FAB bank salary check account balance. These methods include:

- FAB Mobile App

- FAB Online Banking Website

- ATM

- SMS

- Phone Banking

- Visit the FAB branch

Let’s discuss how to check your salary through these methods in guided steps in detail.

FAB Bank Salary Account Balance Check – 6 Proven Methods (Online + Offline)

To check the FAB bank salary account balance, you can use the following methods. Here are all the methods in detail:

Method 1: FAB Bank Salary Account Balance Check Online using the FAB Mobile App

The first method you can use to do a FAB bank salary account balance check is the FAB mobile app. It is the online method that requires an internet connection. It provides you with real-time information about your balance at any time.

Here is how you can use the FAB mobile app to check your FAB salary balance:

Steps

- Install App: Install the FAB mobile app from the Google Play Store or App Store.

2. Register

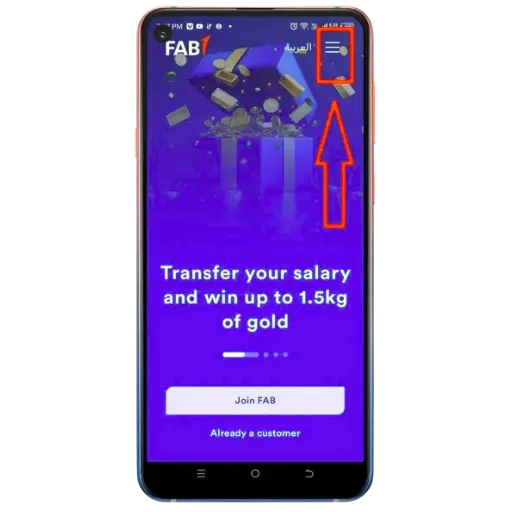

- Open the app on your mobile.

- Click on the Menu section.

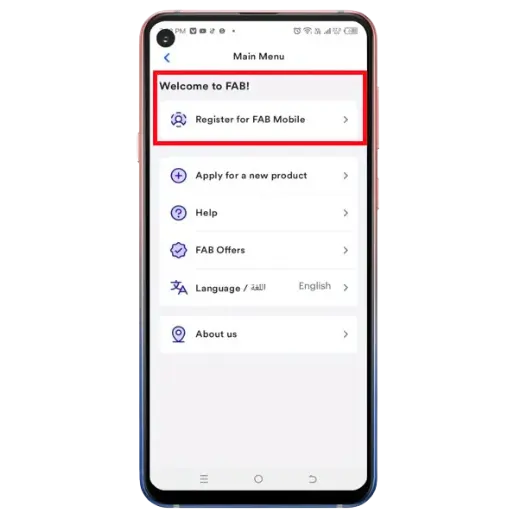

- On the Menu, click on “Register for Mobile account”.

- Register through your email and Emirates ID.

- Set your username and password.

3. Confirm Account: Confirm your FAB mobile account via email.

4. Log In: Log in through the username and password you set during signup.

5. View Balance: View your balance on the home screen.

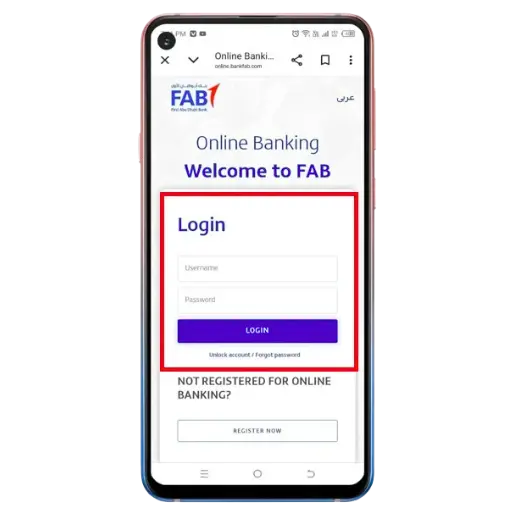

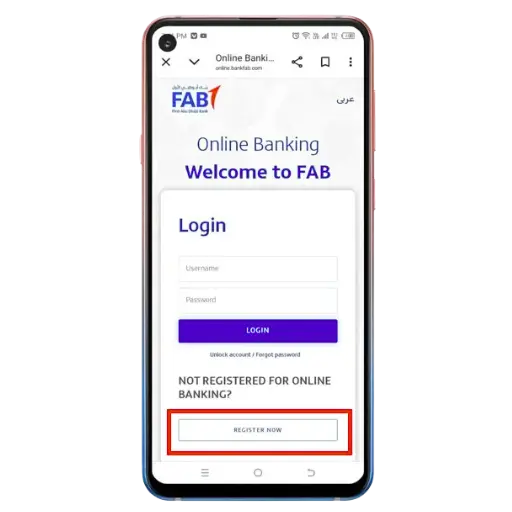

Method 2: FAB Online Banking Website

If you want to know your salary balance and recent transactions in detail, you can opt for the FAB online banking website. You can use this method to do an FAB salary balance check in detail on a Desktop or PC.

Here are the detailed guided steps:

Steps

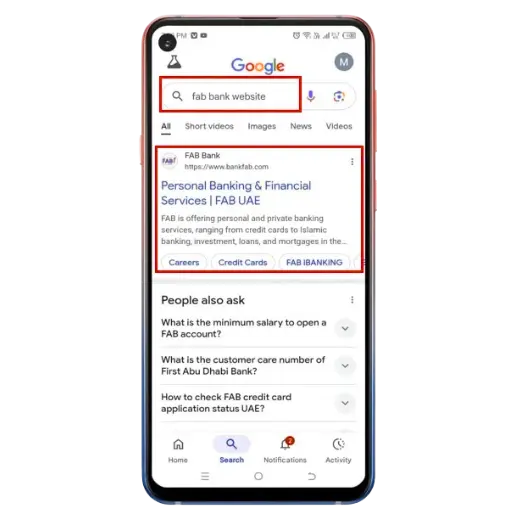

- Search Website: Search for the FAB online website on Google or any other search engine.

2. Sign Up: Click on “Register Account” under the login form..

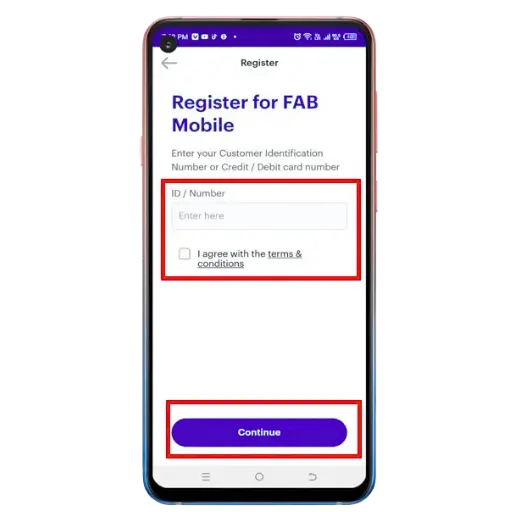

3. Enter Details: Enter your customer ID number and your credit/debit card for registration.

4. Log In: Log in with the credentials.

5. View Balance: View your balance on the home screen.

6. For Detailed Balance: Click on the accounts tab and check your recent transactions.

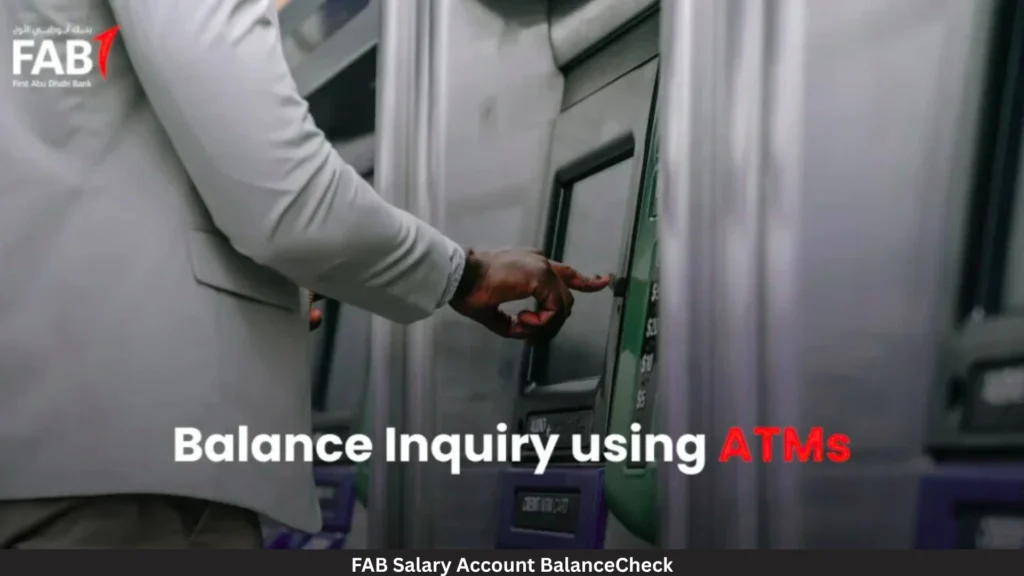

Method 3: FAB Bank Salary Account Balance Check using ATM Balance Inquiry

The most widely used method for FAB bank salary account balance check is the ATM. It is the offline method. Customers primarily use this method for checking their balances. Here are the guided steps in detail:

Steps

- Bring the FAB debit card or your salary card with you to the ATM for the balance inquiry.

- Visit the ATM: Visit the ATM nearest to you.

- Insert Card: Insert your FAB salary card in the ATM.

- Enter PIN Code: Enter the 4-digit PIN code of your Card.

- Select Language: Select your language from Arabic and English.

- Select Option: Click on the “Check Balance” option.

- Select query type: Select “Print Receipt (Charges may apply)” or online option.

- Check Balance: Check your balance in hard or soft.

Method 4: SMS Banking

Steps

- Open SMS app: Open your SMS app on your mobile.

- Compose SMS: Click on “create message” to compose the SMS.

- Enter card details: Please enter your FAB salary card details.

- Send SMS: Send your message to 2121.

- Receive Balance: Receive your Salary balance through SMS.

Note: Please be aware that checking your FAB salary card balance may incur a small fee.

Method 5: DAB Bank Salary card balance check on Phone Banking / Helpline

Steps

- Gather Documents: Always keep your ID card and debit/credit cards with you.

- Phone Numbers: You can use the following numbers for the phone call.

- For Customers within the UAE: 600 52 5500 For Customers outside the UAE: +971 2 681 1511

- Contact: Call the help center at the following numbers.

- Provide details: Provide your complete information during the call to receive your balance.

- Ask About Balance: Ask the agent about the balance.

- Get your Balance: Get your balance in detail from the agent.

Method 6: FAB Bank Salary Card Balance Check on FAB Branch

Steps

- Visit the bank: Visit the nearest bank branch.

- Keep Documents: Please bring the necessary documents, including your ID and bank card.

- Obtain the token: Retrieve the token from the token machine.

- Wait for your turn: Wait for your turn and take a seat.

- Contact the Bank Representative: Speak with the person assigned to assist you.

- Get your balance: Get your bank balance from the bank person.

FAB Bank Salary Account Balance Check for International Customers

If you’re outside the UAE or an international customer, SMS banking will not be available to you. However, you can use the other five methods for the FAB bank salary account balance check. Here is the list of the other five methods:

- FAB Mobile App

- FAB Online Banking Website

- ATM

- Phone Banking

- Visit the FAB branch

Why You Should Check Your FAB Salary Account Balance Regularly?

You should check your FAB salary Balance regularly, as it can be very helpful. It has various advantages. Here is why you should do a FAB bank salary account Balance check regularly.

- Unauthorised Transactions: If you check your salary balance regularly, you can keep an eye on unauthorised transactions. It is a good step to keep your money safe.

- Avoid Overdraft Fees: You can avoid overdraft fees from the bank if you check your balance regularly. It will be a good addition to your bank track record.

- Track Your Financial Progress: By performing regular balance checks, you can monitor your financial progress and assess your gains and losses.

- Avoid Overspending: If you keep an eye on your expenses, you can see how much money you have for the remaining days of the month. You can avoid overspending altogether.

What is the FAB Salary Account?

The FAB salary account is the bank account offered by First Abu Dhabi Bank. It is made specifically for people who receive a salary. The salary balance should be a minimum of AED 5000.

The FAB salary account suits IT experts, Real Estate Professionals, and other jobs with high salary potential. If you open this bank account, you must have a monthly salary of AED 5,000. It is the only condition from the bank.

Key Benefits of Using the FAB Salary Account for Your Salary

If you open a FAB salary account, you can have the following benefits:

1% Cash Back: FAB Bank offers a 1% cash back policy for salary accounts. If your salary is AED 5000, you can get a cash back of AED 50. It becomes AED 600 in a year. It is a great opportunity for employees to receive cash back.

Digital Support: FAB offers 24/7 customer support to its customers. If you open the FAB salary account, you can also grab this support from the bank.

No Maintenance Fee: There is no maintenance fee for the FAB salary account. It means the bank charges zero fee to the account holders.

Free Check Book: FAB salary account offers a free cheque book, a FAB credit card and a FAB debit card plus free utility bill payments.

Eligibility Criteria and Documents Required

The eligibility criteria for the FAB salary account are simple. Here are all the eligibility conditions and documents listed below:

Eligibility Criteria

- The applicant must be a UAE resident

- He should be salaried or self-employed.

Documents Required

The documents required to open a FAB salary account are:

- Emirates ID, Copy or Original Passport, or Any Other Residency Proof

- Filled Registration Form

- Proof of income (It is proof that the customer can maintain the minimum balance)

Note: These document requirements may vary for different accounts. So, check for each type of account document.

FAB Salary Account vs Ratibi Card – What’s the Difference?

FAB Salary account and Ratibi card have different requirements and benefits. Here is the difference.

Features | FAB Salary Account | Ratibi Prepaid Salary Card |

|---|---|---|

What is it? | Fully featured banking solution | Payroll solution |

Bank Account Needed | Yes | No |

Cheque Book | Yes | No |

Mobile and Online Banking | Full access | Full access |

Minimum Balance Requirement | Yes(varies from account to account) | No |

24/7 Customer Support | Yes | Yes |

ATM Service | Yes | Yes |

Best For | Professionals, Office staff, Skilled workers | Blue-collar employees, labourers |

Common Issues While Checking FAB Salary Balance

Customers face several issues while doing a FAB bank salary account balance check. Here are some common problems you may encounter when checking your balance.

Login Issue: When attempting to log in online on the website or app, you may encounter issues. You can forget your password or enter it incorrectly. There can be a typo in your username or password. To resolve this issue, please recheck your credentials. If it doesn’t work, click on “Forgot Password” and reset your password.

ATM Card Swallowed: When we check the balance from the ATM, it may swallow our card. Contact the nearest branch and tell them the issue.

Zero Balance issue: Sometimes, you may encounter a zero balance issue. It can be due to a low network connection. Try again when the internet is restored.

Security Tips for FAB Salary Account Users

Here are some security tips you can follow to save your account and passwords from being stolen:

Never share your Password: Never share your password with anyone except a bank official agent. It may cost you a lot, as someone can steal your money and balance.

Never share ATM PIN: Do not share your ATM PIN with other customers. If you don’t know how to check your balance at an ATM, visit your bank branch.

Keep the cheque book secure: Store your cheque book in a secure location, such as a locker. Someone can steal it even from your house.

If someone asks you to share your personal information, do not share it. Be aware, be safe.

Conclusion

We have shared how you can do a FAB Salary card balance check using different methods. All the methods have 24/7 support. You must know that your salary should be based on a minimum balance. If one method doesn’t work, you can choose another one.

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.