FAB Online Banking – UAE’s Leading Digital Banking Experience 2026

When I first heard about FAB Online Banking, I honestly wasn’t sure what to expect. Like many in the UAE, I used to spend hours visiting branches just to manage routine tasks, whether it was checking my FAB balance online transferring funds, or paying a bill. It was time-consuming and stressful. That all changed when I discovered First Abu Dhabi Bank Online Banking. Today, I handle almost everything from my phone or laptop, saving both time and effort. In this guide, I’ll share my comprehensive experience using FAB Online Banking UAE, including how to register, log in, and maximize its features.

What is FAB Online Banking?

Overview of First Abu Dhabi Bank (FAB)

First Abu Dhabi Bank (FAB) is not just another financial institution; it’s the heart of the UAE’s modern banking transformation. Established after the merger of two of the UAE’s largest banks, it represents trust, innovation, and digital excellence. Over the years, FAB has built an ecosystem of services that make personal and business banking simpler, smarter, and safer. The introduction of FAB Internet Banking was a pivotal moment that transformed how customers interact with their accounts, marking a major step in digital banking regulation in the UAE and financial innovation across the region.

FAB’s Position in the UAE Banking Sector

FAB today stands as a benchmark for digital banking excellence. Its presence across the Middle East and international markets gives it credibility and reach. Among all UAE banks, FAB consistently ranks among the top in terms of customer satisfaction, digital integration, and innovative tools. Whether you’re managing a FAB Savings Account, a Business Account, or even an iSave Account, the platform offers one of the most seamless digital experiences in the country.

Key Features of FAB Online Banking

What makes FAB Online Banking unique is the level of personalization. From the moment you log in, everything feels intuitive. You can review your Account Summary, download your Transaction History, or generate a Stamped Statement in seconds. You can also apply for new cards, manage loans, and use digital tools like the FAB IBAN Generator or DBR Calculator. In short, it brings an entire bank to your fingertips.

Benefits of Using FAB Online Banking in the UAE

24/7 Access to Banking Services

When I switched to FAB Online Banking UAE, the first benefit I noticed was flexibility. I no longer had to plan visits during branch hours. Whether it’s midnight or early morning, I can log in, check balances, make transfers, and manage my FAB Credit Card with ease. The platform gives complete control 24/7, a must-have for anyone with a busy schedule.

Easy Account Management & Instant Bill Payments

Managing bills used to be one of the biggest hassles in my routine. With FAB Internet Banking, that changed completely. I can pay telecom, DEWA, and other utility bills instantly through the Online Bill Payments FAB section. The best part? You can schedule Recurring Bill Payments, ensuring you never miss due dates again. It’s efficient, transparent, and accessible both on desktop and through the FAB Mobile App.

Quick Fund Transfers (Local & International)

The FAB Money Transfer service has simplified both local and global remittances. Whether I’m transferring to another UAE bank or sending funds abroad through a FAB International Transfer, the process takes just a few clicks. As an expat, I find the Free Remittance feature to Pakistan, India, Sri Lanka, and the Philippines incredibly valuable. The exchange rates are competitive, and transfers are almost instant.

Time and Cost Efficiency

Another huge benefit of FAB Online Banking is the cost efficiency. Traditional transactions often come with processing fees and waiting time. Through FAB Bank Online, I’ve been able to avoid unnecessary charges and save valuable time. Even loan applications and FAB Credit Card Bill Payments are now paperless, which means less hassle and faster approvals.

Enhanced Security and Privacy

FAB has integrated strong digital safety protocols within FAB Online Banking Security. Every login requires Two-Factor Authentication, and sensitive actions like transfers or profile updates trigger OTP Verification. The platform also supports Biometric Login via fingerprint or face recognition for mobile users. I always feel safe knowing FAB has one of the best Fraud Protection systems in the region.

Available in English and Arabic

Living in a multilingual country, I truly appreciate that FAB Online Banking UAE supports both English and Arabic. Even the FAB Mobile App can be toggled between languages. This inclusive approach ensures everyone, locals and expats alike, can enjoy the full Digital Banking Solutions UAE experience.

How to Register for FAB Online Banking

Step-by-Step Guide for New Users

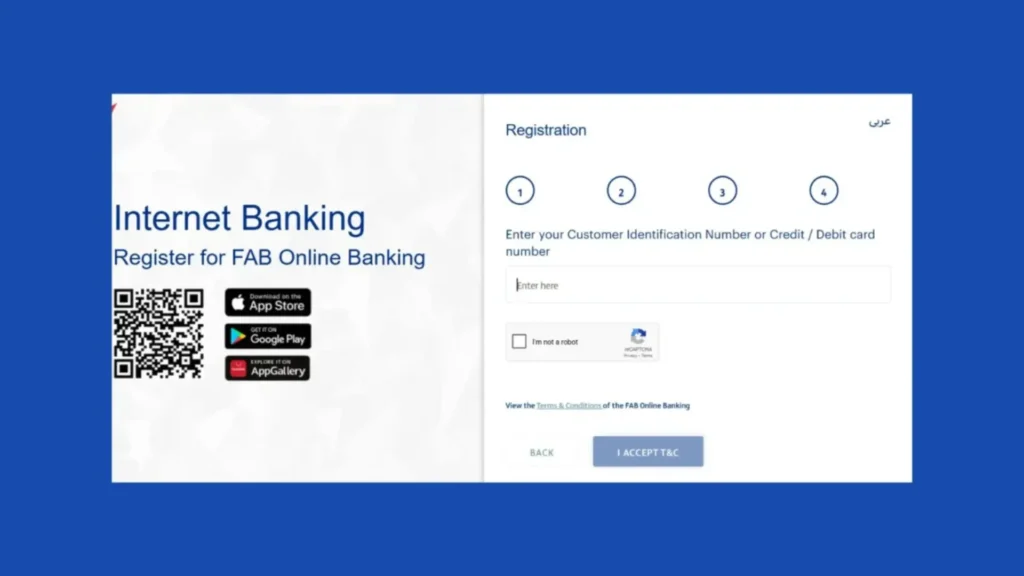

Setting up FAB Online Banking took me only a few minutes. Here’s what I did:

- I visited the FAB Registration Page on their official website.

- Selected “Register for Online Banking.”

- Entered my Customer Identification Number (CID) and card details.

- Verified my mobile number using an OTP.

- Created a secure password and activated my account.

Once done, I immediately gained access to my FAB Account Summary and could start transferring money or paying bills right away.

Required Documents and Information

All you need for registration is your FAB Debit or Credit Card, registered mobile number, and Emirates ID. Having your documents ready helps ensure your profile is linked securely to your FAB Account Access UAE.

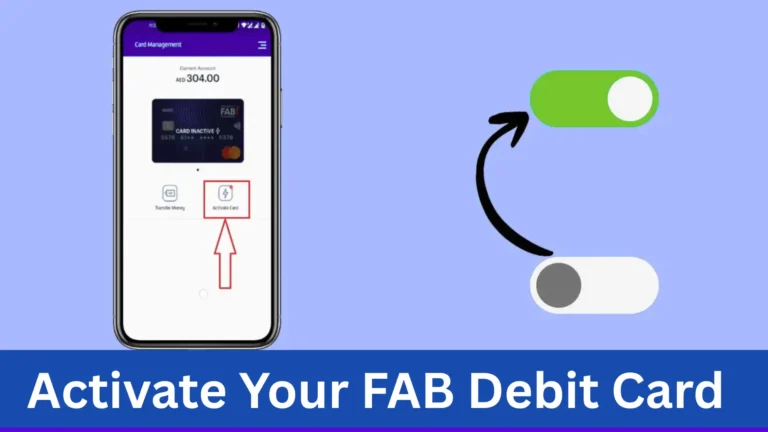

Activation Through Mobile or Web Portal

You can register either through the FAB Website Login page or the FAB Mobile App. I personally prefer the web version for setup, then I manage everything through the app later for convenience.

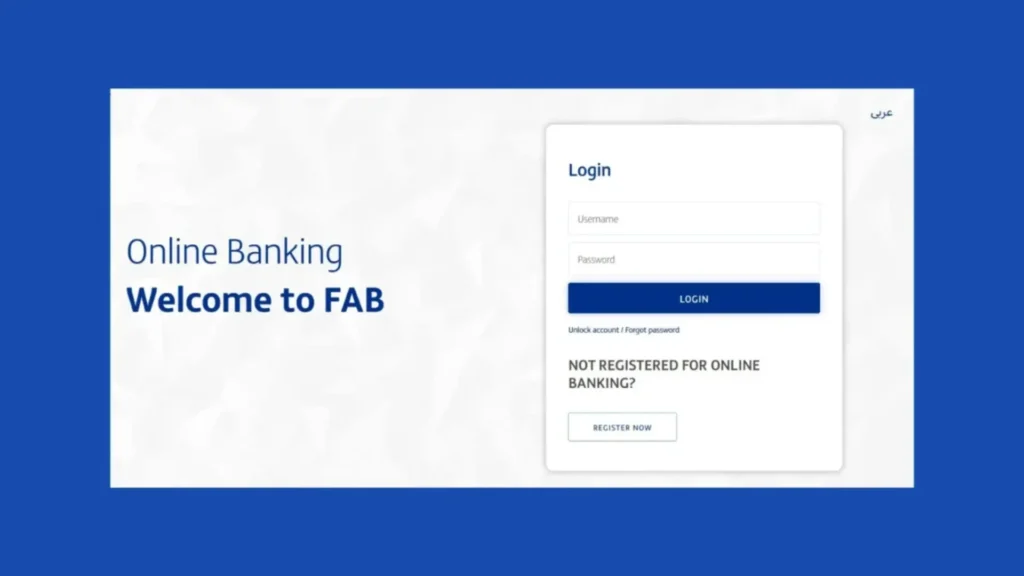

How to Log in to FAB Internet Banking

Logging into FAB Internet Banking is as simple as it gets. Go to the FAB Official Website Login, enter your User ID and password, and verify with an OTP sent to your registered phone. The login system is fast, and I especially like the Biometric Login feature on mobile, one tap and you’re in.

FAB Mobile Banking App – Features & Benefits

Downloading the FAB App (Android & iOS)

The FAB Mobile App is available for both Android and iOS. I downloaded it from the Play Store, and setup took less than five minutes. Once installed, I linked my online banking profile and was able to access my FAB Accounts, cards, and investment tools immediately.

Key App Features (Transfers, Bill Payments, Card Management)

Inside the app, you can perform FAB Fund Transfers, pay bills, manage FAB Credit Card Balances, and even request a Card PIN Reset. One thing I like is that it shows a real-time breakdown of my expenses, helping me track my spending habits effectively.

FAB Loans & Investment Management on App

For anyone managing finances, the app’s Loan and Investment Management tools are incredibly practical. You can check your loan eligibility using the FAB Personal Loan Calculator, or explore FAB Investment Services to diversify your portfolio. I personally use the FAB Loan Management tab to monitor my repayments and tenure progress.

Requesting Cheque Books via Mobile App

Need a new cheque book? Just head to “Requests” and select FAB Cheque Book Request. Within a few business days, it’s delivered to your registered address, no branch visit required.

Security Features of FAB Digital Banking

The FAB Mobile App follows the same stringent protocols as the web version, from FAB OTP Verification to Fraud Prevention Tools. Every transaction is encrypted to keep your data protected.

Services Offered Through FAB Online Banking

Fund Transfers (Local and International)

One of the core strengths of FAB Online Banking is its transfer flexibility. With FAB Local Transfer, you can move funds instantly between UAE accounts, and FAB International Transfer supports over 200 global destinations. The rates are transparent, and I appreciate that FAB confirms all charges upfront before finalizing a transfer.

Utility and Government Bill Payments

From electricity to traffic fines, I handle everything through Instant Bill Payments FAB. You can even link favorite billers for quick access. The convenience of paying multiple bills through one dashboard is one of my favorite features.

Online Credit Card and Loan Management

I can apply for a FAB Credit Card Online, check my FAB Debit Card Balance, and convert purchases into Payment Installment Plans with one click. I also view my FAB Credit Card Statement monthly, without ever needing paper mail.

Request Cheque Books, e-Statements & Account Settings

Another underrated feature is the ability to download FAB Stamped Statements and make Account Detail Updates like email, phone number, or address, without visiting a branch. For me, this is true Digital Banking Convenience.

Important Tools and Calculators on FAB Digital Banking

IBAN Generator

Every time I need to share my IBAN, the FAB IBAN Generator tool saves me. Just input your account number, and it generates your IBAN instantly.

Branch & ATM Locator

Even though I rarely visit branches now, the FAB Branch & ATM Locator has helped me locate nearby ATMs when needed. It’s integrated with maps for real-time navigation.

Debt Burden Ratio Calculator (DBR)

Before applying for a new FAB Loan UAE, I use the DBR Calculator to check my repayment capacity. It’s simple yet powerful for personal budgeting.

Personal Loans Calculator

The Personal Loan Calculator FAB shows estimated EMIs based on interest rates and tenure. It’s an excellent planning tool if you’re considering a FAB Personal Loan.

How to Transfer Money Through FAB Online Banking?

Transferring money through FAB Online Banking couldn’t be simpler. Once logged in:

- Click on “Transfers.”

- Choose between Local or International Transfer.

- Add recipient details (or select saved ones).

- Enter the amount and confirm with OTP.

Funds are usually credited instantly within the UAE and within hours internationally. The FAB Remittance Transfer feature makes cross-border transactions incredibly smooth.

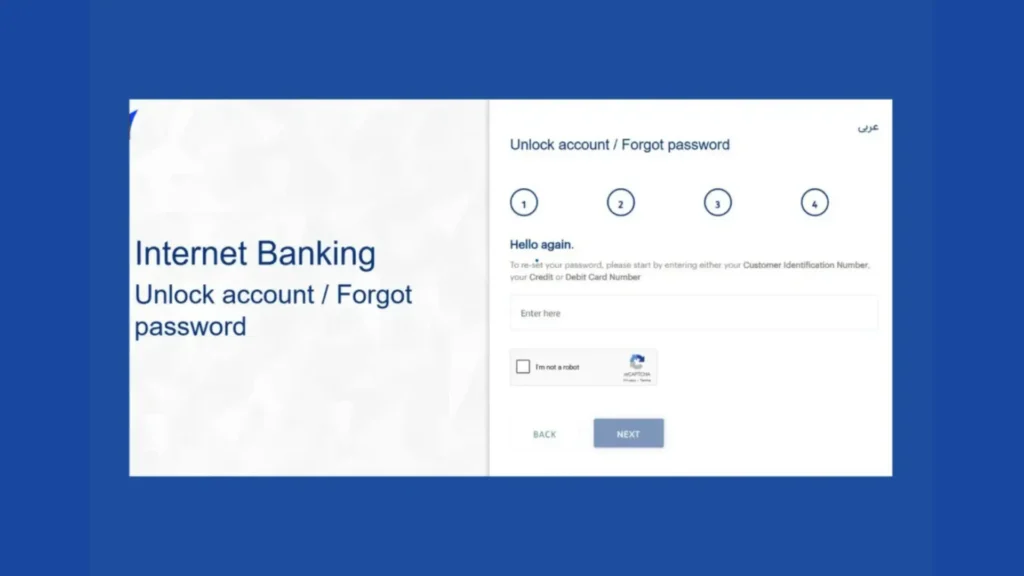

How to Reset or Change Password for FAB Online Banking?

If you ever forget your password, go to the FAB Website Login page and click “Forgot Password.” Enter your CID, verify your phone number, and set a new password. It’s fast, secure, and completely online. I’ve used it once, and it took less than two minutes.

FAB Online Banking Security – How Safe Is It?

Multi-Factor Authentication (MFA)

Every login and major transaction goes through Multi-Factor Authentication, combining your password, OTP, and biometric identity part of FAB’s advanced online and offline security measures that keep customer data fully protected.

Secure Login and Encryption Technologies

FAB Secure Internet Banking uses high-level SSL encryption to protect data in real time. I’ve noticed that even if I log in from a new device, FAB sends an instant alert for confirmation.

Best Practices & FAB’s Security Tips

FAB advises all users to avoid public Wi-Fi, never share OTPs, and enable real-time notifications. I’ve followed these practices religiously and never faced a single issue.

Update Your Details via FAB Online Banking

How to Update Mobile Number

I recently had to update my phone number, and it took under five minutes on FAB Online Banking. I simply opened “Profile Settings,” entered my new number, and verified it with OTP.

How to Update Passport / Visa Details

For expats, updating passport or visa details online is a blessing. Under the “Documents” section, you can upload the latest versions, and FAB verifies them quickly a great example of how FAB Online Banking for Expats saves time.

Common Issues and How to Solve Them

Forgot Password or User ID

If you forget your login details, the FAB Password Reset Guide will walk you through recovery using your CID and registered mobile. I’ve tried it once, and it’s foolproof.

Account Locked – What to Do?

Should your FAB Online Account get locked after failed login attempts, use “Unlock Account” on the website. If that doesn’t work, contact FAB Helpline UAE for instant unlocking.

FAB Online Banking Customer Support

FAB’s 24/7 Customer Care has been outstanding in my experience. I’ve reached them via both phone and live chat, and they always resolve my concerns promptly.

Final Thoughts – Why Choose FAB Online Banking in the UAE?

Summary of Advantages

After years of personal use, I can confidently say FAB Online Banking is one of the most advanced digital banking systems in the region. It’s efficient, secure, and constantly evolving. From FAB Credit Card Management to Online Bill Payments and Fund Transfers, everything works flawlessly.

How It Compares With Other UAE Banks

Compared to other UAE banks I’ve used, FAB stands out for its Security Features, Customer Support, and smooth integration across FAB Digital Channels. Whether you’re an expat or a business owner, it’s the perfect platform for modern financial management.

In conclusion, FAB Online Banking UAE has transformed the way I handle my finances. It brings banking convenience, speed, and safety into one powerful platform. From everyday transactions to advanced financial tools, it’s everything a modern user needs. If you haven’t tried FAB Internet Banking yet, now is the perfect time to experience the UAE’s most reliable and secure digital banking ecosystem.

FAQs

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.