FAB Credit Cards in UAE (2026) – Compare Types, Benefits, Fees & How to Apply

Over the years, I’ve noticed one common issue among many UAE residents most rely on basic debit cards or outdated credit cards that barely offer any real value. With the cost of living on the rise, every dirham truly matters. That’s exactly where FAB Credit Cards stand out. They’re designed to give you more more cashback, better travel perks, and smarter digital control over your spending all while you can easily check FAB balance online anytime.

In this 2026 guide, I’ll walk you through everything you need to know about FAB Credit Cards their types, benefits, eligibility, fees, and even how to apply online. Whether you’re looking for a simple free-for-life card or an elite Signature option with lounge access and Etihad Guest Miles, I’ll help you find the one that fits your lifestyle best.

What is a FAB Credit Card?

A FAB Credit Card, offered by First Abu Dhabi Bank (FAB), brings together convenience, security, and rewards all in one place. These cards let you shop, pay bills, and travel globally while earning cashback, rewards points, and exclusive offers from brands like Etihad, du, and Visa partners.

From my personal experience, FAB cards are among the most flexible and transparent options available in the UAE. Whether you’re spending at home or abroad, every swipe counts toward something meaningful be it travel miles, cashback, or discounts on everyday purchases.

How FAB Credit Cards Work in the UAE

FAB Credit Cards work just like any international Visa or Mastercard. You can use them anywhere in the world, and they integrate seamlessly with FAB Online Banking for real-time tracking, balance checks, and payments. Through the FAB Mobile App or online banking, you can track transactions, check balances, redeem rewards, or pay your bill all in real time.

What really sets FAB apart, in my opinion, is the control it gives you. You can monitor spending patterns, set card limits, or lock and unlock your card instantly from the app. It’s a modern, mobile-first experience built for people who like to stay on top of their finances.

Who Should Apply for a FAB Credit Card?

In my view, FAB has a card for almost everyone from salaried professionals and frequent travelers to business owners.

If you value cashback, luxury travel benefits, or lifestyle rewards, FAB has options for every need. Salaried individuals can easily get a free-for-life card. At the same time, executives and entrepreneurs can go for the Signature or Infinite range, which come loaded with premium benefits and global privileges.

Types of FAB Credit Cards Available (2026)

FAB’s lineup is quite diverse from entry-level cards to premium travel companions. Here’s a quick overview:

Standard FAB Credit Card

Perfect for beginners or first-time credit users. The Standard FAB Credit Card offers basic benefits like online payments, reward points, and access to the FAB Rewards portal. It’s a solid choice to start building your credit history responsibly.

Islamic / Shariah-Compliant Credit Card

For those who prefer ethical banking, the FAB Islamic Credit Card follows Shariah-compliant banking principles, avoiding interest (riba). Yet, it still gives you cashback, travel perks, and shopping offers all within a compliant framework.

Gold & Platinum Credit Cards

If you’re looking for a balance between value and benefits, the FAB Platinum Credit Card is worth considering. You get discounts on movie tickets, dining offers, and even flexible instalment plans sometimes free for life. I’d say it’s ideal for daily spenders who want solid value without high annual fees.

Signature & Infinite Cards (Premium Segment)

Now, if you love premium experiences, the FAB Signature and Infinite Credit Cards are the way to go. You get access to 1,000+ airport lounges, free travel insurance, Etihad Guest Miles, and even school rewards for families through GEMS. These cards are built for professionals who appreciate first-class service wherever they go.

Travel & Cashback Credit Cards

Personally, I find FAB’s Travel and Cashback Credit Cards the most rewarding for everyday use. You earn cashback on groceries, dining, and utilities while collecting Etihad miles for every flight. If you travel frequently or enjoy lifestyle perks, these cards are truly worth it.

Key Features and Benefits of FAB Credit Cards

Here’s what makes FAB Credit Cards stand out:

1. Cashback, Rewards, and Loyalty Points

Every purchase adds up. You earn cashback on fuel, groceries, and international spends, while FAB Rewards can be redeemed for flights, cinema vouchers, or even bill payments. The FAB Cashback Credit Card, in particular, offers great value for money it really helps you save with every swipe.

2. Travel Perks and Lounge Access

As someone who travels often, I find the travel perks of FAB Signature and Infinite cards outstanding. Free lounge access, travel insurance, and guest privileges can truly make your journey smoother and more comfortable.

3. Instalment Plans & Balance Transfers

FAB makes managing big expenses much easier. You can convert large purchases into 0% instalment plans or transfer your balance at lower rates. It’s a practical feature for anyone managing multiple payments.

4. Security Features & Digital Banking

Security has always been a major focus for FAB. You get real-time fraud alerts, two-factor authentication, and zero liability protection. Through the mobile app, you can monitor spending, set limits, or instantly block your card complete control at your fingertips.

FAB Credit Card Eligibility Criteria & Required Documents

Salary-Based Eligibility

Most FAB Credit Cards require a minimum salary between AED 5,000 and AED 15,000.

- FAB Platinum and Cashback Credit Cards – great for mid-income earners.

- FAB Signature and Infinite Credit Cards – best suited for higher-income professionals or executives.

UAE Residents & Expats

Both UAE nationals and expatriates can apply. Expats just need a valid residency visa, an Emirates ID official website, and proof of income or employment.

Required Documents

To apply, you’ll need:

- Emirates ID

- Passport and visa copy

- Salary certificate or employment letter

- Latest 3–6 months’ bank statement

How to Apply for a FAB Credit Card (Step-by-Step)

Applying for a FAB Credit Card is simple and takes just a few minutes.

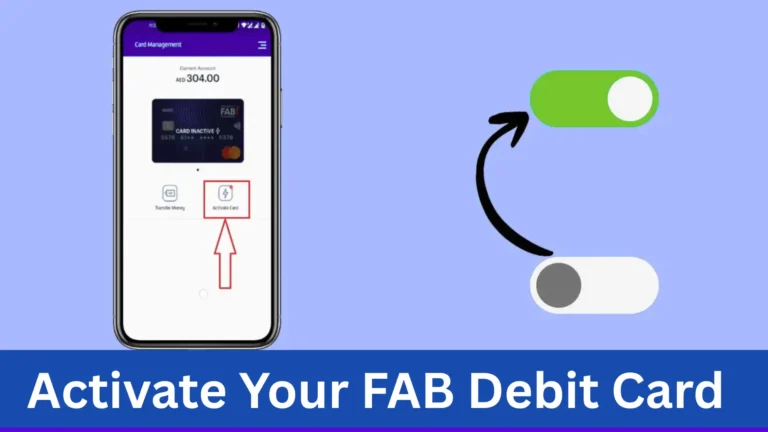

1. Through the FAB Mobile App

- Download and log in to the FAB App.

- Head to the “Credit Cards” section.

- Choose your preferred card type (e.g., Platinum, Signature, or Etihad).

- Upload the required documents and submit.

- You can track your application status directly in the app.

2. Via Online Banking

If you’re an existing customer, log in to manage your FAB Credit Card online, go to “Credit Cards,” fill in your details, and submit your application. You can even manage or pay your card bill from the same dashboard.

3. Through a Branch or Representative

If you prefer face-to-face assistance, just visit your nearest FAB branch or connect with a sales representative. They’ll help you check your eligibility and guide you through the process.

FAB Credit Card Fees & Charges (2026 Latest Update)

It’s always smart to understand the costs upfront.

- Annual Fees: Many cards, like the FAB Platinum, are free for life. Premium cards like Infinite come with higher fees, but the benefits miles, lounges, insurance easily justify the cost.

- Foreign Transaction Fees: Usually around 2–3% on international spending.

- Cash Withdrawal Fees: Vary by card type but remain competitive.

- Late Payment / Over-limit Fees: Standard across the UAE, but you can easily avoid them by setting up auto-pay or reminders in the FAB App.

What I appreciate most about FAB is its transparency — no hidden fees or surprise deductions. Everything is clearly displayed in your account.

Credit Card Protection & Security Features

FAB uses advanced fraud monitoring to protect every transaction. You’ll receive instant alerts for all activities, and if something seems off, you can freeze your card right from the app. Plus, with zero liability protection, you’re not responsible for unauthorized transactions a huge peace of mind in today’s digital world.

Comparison: FAB Credit Card vs FAB Debit Card

Feature | FAB Credit Card | FAB Debit Card |

Spending Power | Spend now, pay later | Spend what’s in your account |

Rewards | Cashback, miles, points | None or limited |

Credit Building | Improves credit score | No credit impact |

Travel Benefits | Lounge access, insurance | None |

Ideal For | Frequent spenders, travelers | Basic daily use |

If your goal is to earn rewards, build credit, and enjoy lifestyle perks, the FAB Credit Card is clearly superior to a regular FAB Debit Card when it comes to rewards and benefits.

Common Issues & Their Solutions

1. Transaction Declined:

Check your available credit limit or ensure your card isn’t expired or blocked

2. Card Blocked or Frozen:

Contact FAB support or simply unblock it through the app. Make sure your registered mobile number is active for OTPs.

3. Credit Limit Issues:

If you’ve reached your limit, clear part of your balance or request an increase directly via FAB Online Banking.

Final Thoughts on FAB Credit Cards (2026)

To sum it up, FAB Credit Cards are among the most versatile and rewarding options in the UAE market right now. Whether you’re looking for a no-fee card to manage your daily expenses or a premium one loaded with travel perks, FAB offers something for every lifestyle.

In my experience, the combination of cashback, Etihad Miles, lounge access, and seamless digital banking makes these cards stand out. Additionally, the transparent fees and easy online application process make FAB a solid choice if you’re serious about maximizing the value of your spending.

So, if you’re ready to take control of your finances and turn your daily transactions into real rewards, I’d definitely recommend exploring the FAB Credit Card range today.

Frequently Asked Questions

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.