FAB Debit Card: Features, Benefits, Types, and Eligibility Guide (2026)

The banking landscape in the UAE has become more digital, more convenient, and highly customer-focused over the past few years, and FAB Debit Cards are one of the strongest examples of this transformation. A FAB Debit Card is more than just a payment tool — it acts as a smart financial companion that gives you secure access to your account, protects every transaction, and offers additional lifestyle benefits such as cashback, reward points, travel privileges, and even airport lounge access depending on your card category.

First Abu Dhabi Bank (FAB) is the largest and one of the most trusted banks in the UAE. Both UAE nationals and expatriates widely prefer it because of its strong financial infrastructure, excellent customer service, and seamless digital banking solutions. Whether you need to withdraw cash, shop online, pay bills, or make international purchases, FAB Debit Cards provide smooth access across ATMs, POS terminals, and online platforms worldwide.

What is a FAB Debit Card?

A FAB Debit Card is directly linked to your FAB bank account and allows you to withdraw money, make payments, and take advantage of online and in-app banking features. When you use the card, the amount is deducted instantly from your account balance, which makes it a safe, interest-free, and responsible way to manage your daily expenses.

Unlike a credit card, a FAB Debit Card does not involve loans or interest charges. Instead, it offers complete spending transparency and allows you to track your expenses in real time through the FAB Mobile Banking App or Internet Banking.

Who Should Use a FAB Debit Card?

A FAB Debit Card is ideal for individuals who:

- Prefer complete control over their spending

- Want an interest-free method of payment

- Frequently use ATMs, POS terminals, and online platforms

- Travel regularly and want seamless access to funds abroad

- Prefer secure and verified online transactions

FAB Debit Cards are suitable for UAE residents, expatriates, salaried professionals, students, frequent travellers, and business owners. The type of card that is offered usually depends on your usage needs and banking profile.

Types of FAB Debit Cards Available in 2026

FAB offers multiple debit card variants, each designed for a different type of user and spending behaviour. As of 2026, the most commonly available categories include:

Standard FAB Debit Card

This is the basic card option and is best for everyday usage, such as ATM withdrawals, POS payments, and online purchases. It has low or no annual fees and is ideal for entry-level account holders.

Islamic / Shariah-Compliant Debit Card

This card is designed for customers who prefer Shariah-compliant banking. All transactions follow Islamic finance guidelines and ensure an interest-free banking experience.

Premium and Elite Debit Cards

This segment includes cards such as the FAB Mastercard Platinum Debit Card, which offers additional lifestyle perks like airport lounge access, travel benefits, special dining offers, shopping discounts, and reward programmes. These cards are generally available to high-value account holders or premium salary segments.

Travel and Rewards Debit Cards

For frequent travellers or users who prefer earning points, this category provides additional benefits on international spending, foreign transactions, and airport services. Users can enjoy exclusive travel rewards and premium lifestyle features while transacting abroad.

Key Features and Benefits of FAB Debit Cards

The benefits of FAB Debit Cards go far beyond cash withdrawals. Higher-tier cards provide access to a range of premium services.

Daily Limits and ATM Withdrawals

You can withdraw cash from any FAB ATM in the UAE and from international ATMs through the Mastercard network. Premium cards usually come with higher withdrawal and transaction limits.

Online Shopping and Global Acceptance

FAB Debit Cards are widely accepted on e-commerce platforms such as Amazon, Noon, and airline booking websites. Since they run on the Mastercard network, they are accepted globally at millions of online merchants.

Security and Fraud Protection

FAB offers real-time fraud monitoring, instant alerts, card lock and unlock features, 3D Secure authentication, and zero liability protection in the case of unauthorized transactions. If your card is lost or stolen, you can immediately freeze it through the mobile app.

Rewards, Cashback, and Lounge Access (if applicable)

Depending on your card category, you can enjoy lounge access at selected airports, cashback offers, merchant discounts, and exclusive lifestyle privileges. These benefits make FAB Debit Cards particularly attractive for premium and frequent traveller segments.

FAB Debit Card Eligibility and Required Documents

Obtaining a FAB Debit Card is not difficult, but the eligibility depends on your account type, residency status, and salary classification.

Salary account holders

If you have a FAB Salary Account the debit card is issued automatically along with the account. You do not need any separate approval. Based on the salary-based segment, you may receive a standard, premium, or platinum-tier card.

Non-salary / savings account holders

Those who maintain a savings or current account without a salary transfer receive the debit card based on their account maintenance history. For premium tiers, a minimum balance requirement may apply.

UAE residents and non-residents criteria

UAE residents receive the card with Emirates ID and account verification.

Non-residents are required to provide a passport and a visa page.

Some premium debit cards are also available to non-residents if the minimum balance is maintained.

How to Apply for a FAB Debit Card (Step-by-Step)

The application process is simple, and you can apply either through the bank branch or online.

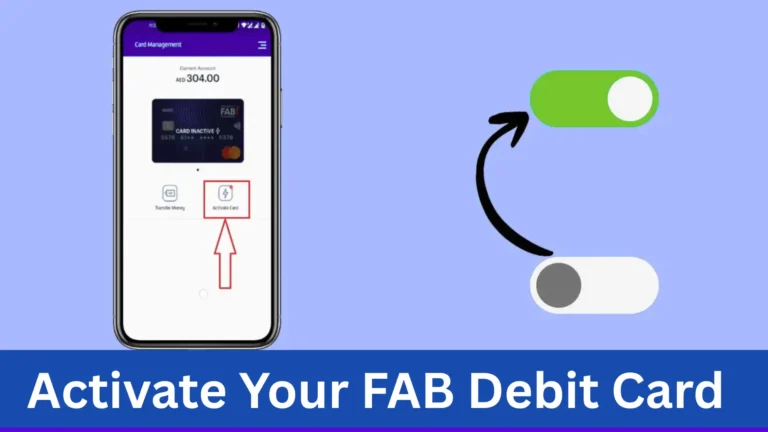

Apply through the FAB Mobile App

Open the FAB mobile app

After logging in, go to the “Cards” section

Click on new debit card request

Select the card type

Once confirmed, your request is processed

Apply via Online Banking Portal

Log in to FAB’s web banking portal

Open the card services section

After debit card selection and confirmation, processing begins

Branch application process

If you prefer physical verification or wish to apply for a premium-tier card, you can visit the branch and submit the request with documents.

FAB Debit Card Charges (2026 Latest Update)

Each card category has a different fee structure, so clarity regarding charges is important.

Issuance fees

Standard debit cards usually have low or zero issuance charges. Premium and platinum cards may require a processing or annual fee.

Renewal and replacement fees

If the card is renewed on expiry, the fee is usually nominal, but in case of loss or theft, additional charges may apply for replacement.

ATM withdrawal fees (Local and International)

Withdrawals from FAB ATMs within the UAE are mostly free.

Other bank ATMs may charge a small transaction fee.

For international ATMs, FX and withdrawal fees are applicable based on Mastercard network usage.

Common Issues and Their Solutions

FAB Debit Cards are generally reliable, but some users may occasionally experience usage issues. Below are the common problems and their simple solutions.

The card is not working internationally

This usually happens when the “international usage toggle” is turned off. You can enable it through the app settings.

POS transaction declined

This occurs when the card limit is exceeded or the POS machine does not support the network. Try again on a Mastercard-supported terminal.

Lost or stolen debit card

If the card is lost, you can block or replace it through the app. If needed, you can also call customer care for an instant block request.

How to Check FAB Debit Card Balance

FAB provides multiple digital and ATM-based options for balance inquiry.

FAB Mobile App

Real-time balance is displayed, and you can also check your transaction timeline.

SMS and USSD

Some FAB accounts offer balance inquiry through SMS banking. You can dial a code or send an SMS to receive an instant update

ATM balance inquiry

You can insert your card at any FAB ATM and view the balance on-screen. This option is convenient for international travellers.

Customer care or branch visit

If digital access is not available, you can obtain balance information by calling customer care or visiting the nearest branch.

Comparison: FAB Debit Card vs Credit Card

Many users are often confused about whether a debit card is better for daily usage or a credit card. Below is a simple comparison:

Spending control

A debit card allows you to spend only according to your available balance, which reduces the risk of overspending. In a credit card, there is a borrowing limit that must be repaid later.

Charges and benefits

Credit cards mostly come with annual fees, interest, and hidden charges, whereas FAB Debit Cards generally have only basic maintenance or ATM-related fees. However, premium FAB Debit Cards, especially those in the platinum tier, can include cashback, travel rewards, and airport lounge access, which previously were common only in credit cards.

Which one is better for beginners?

For beginners, students, salary earners, and users who prefer interest-free banking, a debit card is a safer option. For spending discipline, a debit card is naturally better, while a credit card is useful for those who want to make large payments, installments, or earn travel miles.

Final Thoughts on FAB Debit Card (2026)

FAB Debit Cards provide a secure, reliable, and feature-rich banking experience in the UAE. Whether you are doing daily grocery shopping, making online purchases, or travelling internationally, this card works smoothly everywhere. Because of Mastercard’s network compatibility, usage is possible worldwide. If you choose a premium or platinum-tier card, then additional perks such as loyalty rewards, airport lounge access, fast-track support, and exclusive banking benefits are also available.

In 2026, FAB Debit Cards will no longer be just payment tools but a complete financial lifestyle upgrade. You can track your account balance in real time, view spending history, and manage card settings through the mobile app. For beginners, frequent travellers, expats, and working professionals, this debit card is considered the most convenient and trusted solution in the UAE banking ecosystem.

If you are thinking about upgrading your primary bank card or have recently settled in the UAE, then FAB Debit Cards are a practical, secure, and benefit-loaded choice where both control and convenience remain in your hands.

Frequently Asked Questions

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.