FAB iSave Account: Eligibility, Interest Rates, Opening Process & Full Guide (2026)

Staying financially secure in 2026 requires smart decisions, and one of the most effective steps is choosing a savings account that actually grows your money. The FAB iSave Account has quickly become one of the most preferred savings options in the UAE because of its attractive returns, zero-balance rule, fast opening process, and complete digital control. If you’re looking for a savings account that is effortless, flexible, and rewards you consistently, then the iSave Account is a strong choice to consider.

In this detailed guide, you’ll explore everything about the FAB iSave Account—from eligibility and features to interest rates, documents, opening methods, calculator insights, and expert comparisons. Let’s get started.

What is the FAB iSave Account?

The FAB iSave Account is a digital savings account offered by First Abu Dhabi Bank, designed for fast account opening, competitive interest, and simple money management. It is operated entirely through online banking or the FAB Mobile App, making it perfect for users who prefer digital-first banking without visiting a branch.

This account is known for its no minimum balance, zero monthly charges, and promotional high-interest rates, making it an ideal savings option for individuals planning to grow their wealth while maintaining full control over their funds.

FAB iSave Account Features and Benefits

Before opening any savings account, knowing its key advantages helps you evaluate whether it suits your financial goals. FAB iSave leads the market with some of the most flexible and rewarding features.

Zero Minimum Balance Requirement

One of the standout benefits of the FAB iSave Account is the complete freedom from maintaining a minimum balance. You can keep AED 10 or AED 100,000—the account remains active without any penalties. This makes it accessible for students, salaried individuals, freelancers, and residents who want a hassle-free savings option.

Unlimited Cash Withdrawals

Unlike traditional savings accounts that limit withdrawals each month, the FAB iSave Account gives you unlimited withdrawals without affecting your overall banking experience. This feature is especially valuable for people who want liquidity while maintaining their savings.

Attractive Interest Rates (Promotional & Base Rates)

FAB is known for offering some of the highest promotional interest rates in the UAE through the iSave Account. These promotional rates are frequently updated and applied on incremental balances. Even the base interest rates remain competitive, allowing customers to grow money passively throughout the year.

Whether you deposit AED 1,000 or AED 150,000+, your funds start earning interest instantly.

AED Currency Support

The FAB iSave Account supports deposits and withdrawals entirely in AED, ensuring smooth salary transfers, bill payments, and local transactions. This also eliminates currency conversion charges when using the account for daily banking activities.

Instant Account Opening (Mobile App & Online Banking)

You can open a FAB iSave Account within minutes using the FAB Mobile App or the Online Banking portal. There is no need for branch visits, physical forms, or long verification processes. Everything is handled digitally through the bank’s secure KYC process.

You can learn more about the FAB Mobile Banking App to explore all its digital features.

Automatic Savings Plan

FAB offers an automated savings feature that helps users build disciplined saving habits. You can set an amount to be transferred periodically into your iSave account, ensuring your savings grow steadily without manual effort.

Free Transfers & Alerts

Internal transfers between FAB accounts are free. Additionally, FAB sends real-time alerts for deposits, withdrawals, balance changes, and updates, providing full transparency and security at all times.

Highly Secure Digital Banking

Security is a top priority for FAB. The iSave Account is protected with advanced features including biometric login, OTP verification, multi-layer encryption, and fraud-monitoring systems — ensuring your funds and personal data remain safe.

Zero Maintenance Charges

There are no monthly fees, annual charges, or hidden service costs. This makes the FAB iSave Account one of the most cost-effective savings solutions available in the UAE.

Customer Care & Support Services

FAB provides 24/7 customer support via phone, live chat, email, and branch assistance. Whether you need help with online banking or transaction queries, support is always accessible.

FAB iSave Account Interest Rates Structure

Before opening a savings account, understanding the interest structure is essential. FAB keeps its rate policy transparent and easy to understand.FAB updates its rates in accordance with the Central Bank of the UAE’s financial guidelines, ensuring full transparency and compliance.

Promotional Interest Rates (2023–2026)

FAB regularly launches promotional campaigns, offering rates significantly higher than the standard base rate. These promotions generally target new customers or customers who increase their balance during the promotional period.

Promotional periods typically last a few months and offer excellent opportunities to boost savings quickly.

Base Interest Rates

The base interest rate continues to apply after promotional periods end. FAB’s base rate is stable, making it ideal for long-term savings planning. The base interest ensures your savings continue to grow even without ongoing promotions.

Interest Calculation Method

Interest is calculated on the daily balance and credited monthly. This means the more you maintain in your account daily, the higher your monthly interest earnings will be. FAB’s calculation method is transparent and easy to track using the mobile app.

FAB iSave Account Eligibility Criteria

The eligibility requirements for opening a FAB iSave Account are simple and straightforward.

You qualify if:

- You are a valid UAE resident.

- You have a valid Emirates ID.

- You are 18 years of age or older.

- You have an active UAE mobile number and email.

- You are either an existing FAB customer or a new customer registering for the first time.

FAB iSave Account Requirements

Every account requires basic documentation for verification. FAB simplifies this process as much as possible.

Required Documents for FAB iSave Account

To open your account, you typically need:

- A valid Emirates ID

- UAE residency proof (auto-verified in most cases)

- Passport copy (sometimes requested)

- Active UAE mobile number

- Email address

All documents can be uploaded digitally during onboarding.

How to Open a FAB iSave Account? Step-by-Step Guide

Opening a FAB iSave Account is a simple process that takes only a few minutes when done digitally. Below is a complete breakdown of the steps.

Step 1: Visit the FAB Website or Download the FAB Mobile App

Start by downloading the FAB Mobile App from Google Play or Apple App Store, or visit FAB’s official website.

Step 2: Register or Log In

Existing FAB customers can log in using their online banking credentials. New customers must complete a quick registration, including Emirates ID scanning.

Step 3: Choose iSave Account

Navigate to “Open New Account” and select iSave Account from the list of available account types.

Step 4: Fill in Personal Details

Your Emirates ID details may be auto-filled. Simply verify the information and add any missing details.

Step 5: Upload Required Documents

If the app does not auto-verify your ID, you may be asked to upload documents manually.

Step 6: Review & Accept Terms & Conditions

Go through the account terms carefully and accept them to proceed.

Step 7: Submit the Application

Once you submit the form, FAB reviews your application digitally.

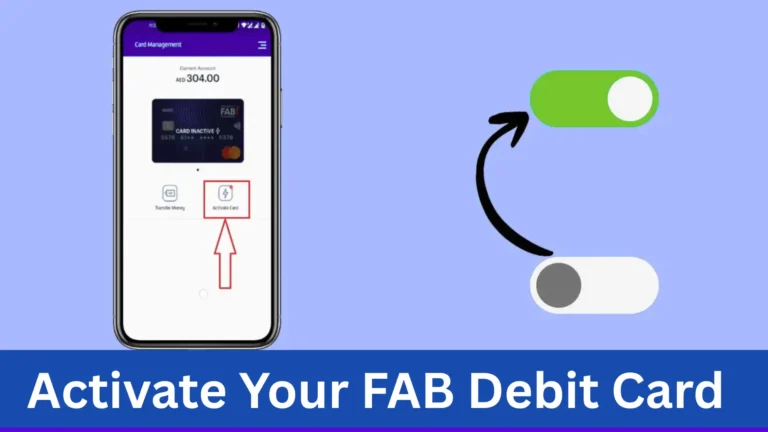

Step 8: Account Activation

Most iSave accounts are activated within minutes. You can then transfer funds and start earning interest immediately.

FAB iSave Account Opening Methods

There are three ways to open the account based on your preference.

Method 1: FAB Online Banking

Perfect for existing customers who prefer desktop access and quick digital onboarding.

Method 2: FAB Mobile App

The fastest and most recommended option. The mobile app streamlines the entire process with instant KYC checks.

Method 3: FAB Branch (Offline)

Some customers prefer visiting a physical branch. FAB staff can assist in setting up your iSave account if needed.

Managing Your FAB iSave Account

Once your account is active, managing it becomes effortless. FAB’s digital tools allow you to:

- Track daily interest

- Transfer funds instantly

- Activate automatic savings plans

- Monitor your balance and transactions

- Set alerts and spending controls

- Access statements anytime

The FAB Mobile App ensures every feature is available at your fingertips.

You can also explore detailed FAB balance check methods to manage your savings and day-to-day banking more efficiently.

FAB iSave Account Terms and Conditions

Before opening your account, it helps to understand key terms:

- The account operates exclusively in AED.

- Promotional interest rates are time-bound.

- Interest is calculated daily and credited monthly.

- FAB reserves the right to update rates based on market conditions.

- KYC and identity verification are mandatory.

FAB iSave Calculator

FAB provides an online iSave Interest Calculator that lets you check how much interest you can earn based on:

- Your balance

- Promotional rates

- Base rates

- Duration of savings

This tool helps you set realistic financial goals and project your savings growth.

FAB iSave vs Other FAB Saving Accounts

Below is a helpful comparison table:

| Feature | FAB iSave Account | Regular FAB Savings Account |

| Minimum Balance | Zero | Required |

| Interest Rates | Higher (Promo + Base) | Standard |

| Opening Method | 100% Digital | Branch + Digital |

| Flexibility | High | Moderate |

| Maintenance Fee | None | May apply |

The iSave account dominates in almost every category, especially for users who prefer convenience and better returns.

Types of First Abu Dhabi Bank Accounts

FAB offers a wide range of account types tailored to different needs.

Savings Accounts

These accounts are designed for interest-earning customers. FAB offers:

- iSave Account

- Smart Save Account

- Regular Savings Account

- Child Savings Account

Current Accounts

FAB’s current accounts are ideal for daily transactions and come with:

- Debit cards

- Cheque books

- Salary transfer options

- Free local transfers

FAB also offers prepaid solutions like the FAB Ratibi Card, ideal for employees receiving salary through payroll cards.

Best Savings Accounts in the UAE (2026)

The UAE banking market is competitive, but in 2026, a few savings accounts stand out:

- FAB iSave Account

- ADCB Active Saver

- Mashreq Neo Savings

- Emirates NBD Lifestyle Account

- RAKBANK RAKsave Account

- HSBC Everyday Global Saver

Among them, the FAB iSave Account ranks high due to its ease of use and attractive returns.

Why Choose the FAB iSave Account in 2026?

Choosing a savings account in 2026 means prioritizing convenience, interest returns, and digital control. The FAB iSave Account ticks all these boxes.

Here’s why it stands out:

- Zero balance requirement

- Fully digital account opening

- Competitive interest structure

- High flexibility

- Secure and modern banking experience

- Automatic savings tools

- Excellent mobile app performance

Whether you’re planning long-term savings or short-term goals, the iSave Account provides unmatched value.

According to the UAE Government Financial Literacy Program, building disciplined savings is one of the strongest financial habits for long-term stability.

Conclusion

The FAB iSave Account stands out as one of the best savings accounts in the UAE for 2026. It combines high interest, zero balance requirements, complete digital accessibility, and excellent security to deliver a powerful savings solution for UAE residents. Whether you’re just starting your savings journey or aiming to grow a substantial financial cushion, the iSave account offers everything you need — simplicity, flexibility, and rewarding returns.

If you want an account that aligns with modern financial needs, the FAB iSave Account is undoubtedly worth considering.

FAQs about FAB iSave Account

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.