FAB Mobile Banking – Complete Guide to Features, Login & Benefits (2026)

Hate waiting in bank lines just to transfer money or check your balance? Fed up with rushing to the branch before closing time for basic transactions? Banking shouldn’t eat up your entire day when you’ve got a hundred other things to handle.

FAB Mobile Banking puts your entire bank in your pocket so you can forget about those frustrating trips. Pay bills, send money, check balances, and manage everything from wherever you are in seconds. This guide breaks down exactly how to set it up and use every feature without confusion.

What is FAB Mobile Banking and How Does It Work?

Before diving into features, it’s essential to understand what FAB Mobile Banking really offers and how it simplifies everyday banking for individuals and businesses alike. The app acts as your digital banking companion, available anytime and anywhere.

Overview of FAB Mobile Banking Services

FAB Mobile Banking is the official digital banking platform of First Abu Dhabi Bank (FAB), the UAE’s largest and most trusted financial institution. It allows customers to perform all essential banking activities using their smartphones, without visiting a branch. You can check account balances, transfer funds, manage debit or credit cards, and even open new accounts instantly.

The app connects directly to your bank account in real time, ensuring every transaction is secure, fast, and recorded instantly. With the FAB Mobile Banking app, your phone literally becomes your personal bank branch.

Why You Should Use FAB Mobile Banking

If you’ve ever wished banking could be faster and easier, FAB Mobile Banking is designed exactly for that. Imagine being able to transfer money while traveling, pay bills while at work, or block your card instantly if it’s misplaced. This is the flexibility that the FAB app offers.

It also caters to international users, allowing global transfers and real-time currency conversion. Plus, with biometric login and multi-layer security, you can manage your finances confidently anywhere, anytime.

Key Features of FAB Mobile Banking App

FAB has designed its mobile app with features that fit the lifestyle of modern users. From balance inquiries to instant fund transfers, it offers everything in one place for complete banking convenience.

24/7 Account Access & Balance Tracking

With the FAB Mobile Banking app, your account is always just a tap away. You can log in anytime, day or night, to check balances, view transaction history, and monitor your spending habits. For instance, if you receive your salary, you can see it reflected instantly in your account, no waiting required.

Easy Money Transfers & Bill Payments

One of the most appreciated features is the ability to make FAB to FAB transfers, local bank transfers, and international remittances effortlessly. You can also pay utility bills like DEWA, Etisalat, and Du, saving you trips to physical counters.

Credit Card & Loan Management

You can manage your FAB credit card, view outstanding balances, pay dues, and track spending patterns directly through the app. Loan customers can check repayment schedules, upcoming EMIs, or even apply for new products conveniently.

Instant Notifications & Spending Insights

FAB Mobile Banking sends real-time alerts for every transaction, keeping you informed and secure. It also categorizes spending, helping you understand where your money goes each month.

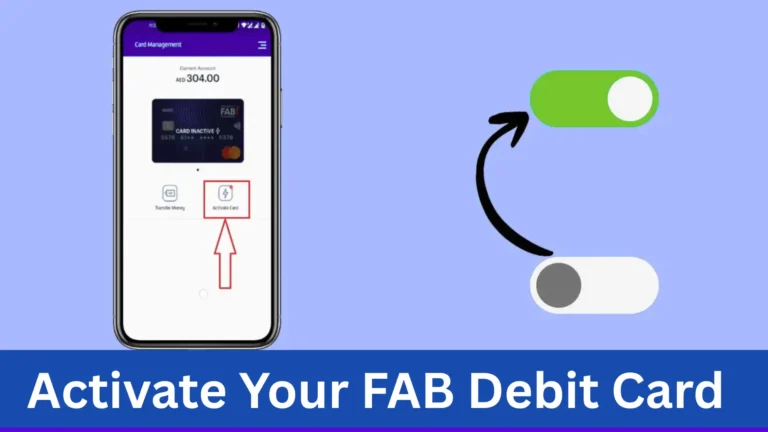

Debit and Credit Card Management

Lose your card? No problem. You can freeze or unfreeze it instantly through the app, request a new one, or set spending limits. This control makes it ideal for those who prioritize financial security.

FAB Exclusive Rewards

FAB offers personalized rewards and cashback offers through its app. From travel benefits to dining discounts, users get exclusive deals just for banking through FAB’s mobile platform.

Update Your Personal Information

The app allows you to update your contact details, Emirates ID, or passport copies directly without visiting a branch, making compliance and account maintenance seamless.

Pay Zakat Instantly

FAB understands the importance of cultural and religious values. You can contribute to your Zakat or charitable causes instantly within the app, ensuring your donations reach the right place at the right time.

Savings and Loan Management

Easily view your savings goals, adjust deposits, and check loan repayment progress all from the FAB Mobile Banking app. It’s perfect for users managing multiple accounts or loans simultaneously.

Recent Updates Rolled Out by FAB in Their Mobile App

FAB continually enhances its mobile app to keep pace with customer needs. The latest 2026 version offers a smoother experience, improved interface, and upgraded safety features for seamless mobile banking.

The latest updates introduced a refreshed interface, faster login, better biometric authentication, and improved transaction tracking. The “Quick Actions” dashboard now allows you to complete your most common tasks in seconds, like balance check, card freeze, or quick transfers.

How to Download and Install FAB Mobile Banking App

Getting started with FAB Mobile Banking is simple. Whether you use Android or iPhone, downloading and installing the app takes only a few minutes.

Download for Android (Google Play Store)

To download on Android, visit the Google Play Store, search “FAB Mobile Banking,” and tap “Install.” The app is lightweight, ensuring smooth performance even on older devices.

Download for iPhone (App Store)

For iPhone users, go to the Apple App Store, search for “FAB Mobile Banking,” and download it. The app is optimized for iOS devices and supports all modern iPhone models.

System Requirements & App Permissions

Ensure your phone has the latest OS version and a stable internet connection. Allow permissions like notifications, contacts (optional), and biometric access for smooth functioning.

FAB Mobile Banking Login Guide (Step-by-Step)

Logging into your account for the first time can be confusing for new users. But with FAB’s intuitive interface, the process takes less than a minute once you’re set up.

How to Login Using Your User ID & Password

Open the app, enter your User ID and password, and tap “Login.” If you’re logging in for the first time, use the credentials sent by FAB or create them during registration.

Enable Biometric Login (Face ID or Fingerprint)

You can enable biometric login for faster and safer access. This feature is both convenient and secure, especially for users who prefer password-free logins.

Login Tips for a Smooth Experience

Always ensure your app is updated, avoid public Wi-Fi while logging in, and remember to log out after every session for better security.

How to Register or Activate FAB Mobile Banking

If you’re new to FAB, registration and activation are straightforward. The process ensures your identity is verified and your account is linked securely with your mobile app.

New User Registration Process

If you’re a new user, download the FAB Mobile Banking app and tap “Register.” Enter your debit or credit card number, followed by your registered mobile number. You’ll receive an OTP to verify your identity.

Account Activation via Mobile Number or Card

You can activate your account using your registered mobile number or account/card details. The system automatically verifies your identity before granting access.

Verifying Your Account Securely

FAB uses two-factor authentication (2FA) for every registration, ensuring your banking details remain secure and private.

How to Transfer Money Through the FAB Mobile App

Money transfers are one of the most-used features of FAB Mobile Banking. It’s designed to be fast, secure, and reliable, both for local and international payments.

FAB to FAB Transfers

Transfer funds instantly to other FAB accounts free of charge. For example, if you’re sending money to a family member who also banks with FAB, the transaction happens in seconds.

Local and International Transfers

You can send money to any local UAE bank account or even abroad using SWIFT transfers. The app shows you real-time exchange rates and transfer fees before confirming the transaction.

FAB Mobile Banking App Benefits for UAE and International Users

For UAE Residents | For Foreigners |

Get features to pay bills such as DEWA, Etisalat, du, etc. | Can manage accounts around the globe. |

Instant FAB balance checking. | Can use the app in any country. |

FAB Rewards earning opportunities. | No need to visit the FAB branch; just install the app and subscribe to the desired FAB product. |

Instant approval on FAB products applies. | 24/7 customer support. |

Verification through Emirates ID | Can see their balance in real-time. |

Quick cash service | Can earn FAB Rewards and then redeem them. |

How Can You Change or Update Your Details in FAB Mobile App

Your personal information plays a vital role in secure banking. FAB Mobile Banking allows users to conveniently update their records directly through the app.

Update Your Registered Email or Mobile Number

Need to change your contact info? Simply go to “Settings” → “Profile” → “Update Details.” Enter the new information and verify it via OTP.

Update Expired Account Documents via App

FAB allows users to upload new Emirates ID, passport, or residency documents directly within the app, ensuring your account stays compliant and active.

Forgot FAB Mobile Banking Password? Here’s How to Reset It

Losing access to your banking app can be stressful, but FAB makes password recovery quick and secure through its verified recovery process.

Steps to Recover Your Password

If you forget your login password, tap “Forgot Password” on the login screen. Enter your User ID and registered mobile number. You’ll receive a verification code to set a new password.

Change or Update Your Login Credentials

It’s wise to change your password regularly. Use a mix of numbers, symbols, and letters for stronger protection.

How to Use FAB Mobile Banking App (Full Walkthrough)

If you’re using the app for the first time, this walkthrough will help you understand how to perform all essential actions confidently and efficiently.

Checking Account Balance & Transaction History

The homepage gives you a snapshot of your balances and recent transactions. You can filter by account type, date, or transaction nature.

Making Local and International Transfers

Transfers are made simple through the “Transfers” tab. You can add beneficiaries, schedule future payments, and view transfer history all in one place.

Paying Bills, Credit Cards & Utilities

FAB has integrated hundreds of UAE billers. From Salik to telecom bills, you can pay instantly without leaving the app.

Managing Beneficiaries and Settings

You can add or remove beneficiaries securely using OTP verification. Customizing settings—like language, notifications, and security preferences is just as easy.

Common FAB Mobile Banking Issues & Quick Fixes

Even the best apps can face small technical issues. Here’s how to identify and fix common FAB Mobile Banking problems in minutes.

Login or App Not Working Problems

If you face login errors, ensure your internet is stable and your app is updated. Clearing the cache often solves minor issues.

Device or Network Errors

Sometimes network restrictions cause errors. Switching to mobile data or restarting your phone usually resolves it.

App Update & Maintenance Tips

During system maintenance, you might see temporary downtime. It’s best to check FAB’s official notifications before assuming an issue.

Security Features & Safe Banking Tips

FAB takes security seriously, implementing advanced systems to safeguard customer data and financial activity. Here’s how FAB ensures your peace of mind.

How FAB Protects Your Transactions

FAB employs multi-layer encryption, biometric authentication, and fraud monitoring systems that track suspicious activity 24/7.

Best Practices for Mobile Banking Safety

Never share your login credentials. Always enable biometric login and use your own private connection for all transactions.

Avoiding Fraud and Phishing Scams

Be cautious of fake messages claiming to be from FAB. Always verify through the official app or customer service before responding.

FAB Mobile Banking App Benefits for UAE and International Users

FAB Mobile Banking is tailored not only for UAE residents but also for expatriates and global clients who require reliable financial access on the go. You can manage multiple currencies, make quick transfers, and track investments easily, no matter where you are.

FAB Mobile Banking Customer Support

If you ever face an issue or have a query, FAB’s dedicated customer support ensures quick help through multiple channels.

How to Contact FAB Support Team

You can contact FAB’s 24/7 helpline directly through the app or by calling 600 52 5500. Their representatives are professional and quick to assist.

Hotline Numbers, Email & Chat Support

The app also includes a “Contact Us” section where you can initiate live chat or send an email for non-urgent queries.

What Cards Does the FAB Mobile App Support?

FAB Mobile Banking supports all FAB debit and credit cards, including conventional and Islamic variants. Whether it’s Visa or MasterCard, you can manage everything from activation to spending limits directly through the app.

Why FAB Mobile Banking is the Smart Choice in 2026

FAB’s mobile app stands out because of its speed, simplicity, and powerful features that make banking effortless and secure.

Benefits Over Traditional Banking

FAB’s mobile banking eliminates the need for branch visits. Every essential service—from card activation to bill payments is digital and secure.

User Reviews and Ratings

Customers consistently rate the app 4.7+ on app stores for its intuitive design, reliability, and security. It’s one of the best-rated banking apps in the UAE.

Final Thoughts

In 2026, FAB Mobile Banking continues to redefine the standards of digital banking in the UAE. With its sleek design, powerful features, and reliable performance, the app gives users complete control over their financial lives. From real-time account management to instant transactions, FAB ensures that every customer enjoys a secure, seamless, and efficient banking experience tailored to modern needs.

If you value convenience, transparency, and flexibility, the fab mobile banking app is more than just a banking tool; it’s a trusted digital partner that grows with you. Whether you’re tracking your expenses, paying bills, or managing multiple accounts, FAB empowers you to handle everything effortlessly from your smartphone. It’s not just about banking; it’s about giving you the freedom to live smarter, save better, and stay financially confident anytime, anywhere.

FAQs Of FAB Mobile Banking

Disclaimer

This website is an independent informational platform and is not affiliated with, authorized by, or associated with First Abu Dhabi Bank (FAB) or any other bank mentioned on this site. All information provided, including fab balance check guides, is for general informational purposes only. Users are advised to verify details through official bank channels before taking any action.